UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | |

|

| SCHEDULE 14A |

|

SCHEDULE 14A |

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 |

|

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only

☐ Definitive Proxy Statement (as (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| | |

| GoDaddy Inc. |

GoDaddy Inc.(Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:required

☐ Fee paid previously with preliminary materials.materials

☐ Check box if any part of the fee is offset as providedFee computed on table in exhibit required by Item 25(b) per Exchange Act Rule 0-11(a)(2)Rules 14a–6(i)(1) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.0–11

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

[Page intentionally blank]

Notice of 2022 Annual

Meeting of Stockholders

to be held on June 1, 2022

We’re a trusted growth

partner to millions of

everyday entrepreneurs.

GoDaddy is a global leader in serving a large market of everyday entrepreneurs. We’re on a mission to empower our worldwide community of 21 million+ customers — and entrepreneurs everywhere — by giving them all the help and tools they need to grow online and in-person.

WHAT WE DO

We empower everyday entrepreneurs around the world by providing all of the help and tools to succeed online and in-person.

We believe we create value for our customers through our unique combination of assets and our customer-inspired innovation. We do the job they ask us to do and truly partner with them at every point of their journey. Our mission is to give our customers the tools, insights and the people to transform their ideas and personal initiative into success.

| | | | | | | | |

WHO WE ARE | | |

6k+ | 21m+ | 84m+ |

More than

6 thousand employees

| We empower 21 million+

everyday entrepreneurs

| Our customers trust us with

their 84 million+ domain names

|

| | | | | | | | |

|

| A Message from Our Board Chair |

A Message from Our Chief Executive Officer

Dear Fellow Stockholders,

| | | | | | | | | | | | | | |

Two and a half years into the CEO role at GoDaddy, I am more excited than ever about the opportunity in front of us. GoDaddy’s vision and mission, which captivated me and inspired me to join, continue to attract the best talent in our industry, positioning the Company for a very bright future. GoDaddy is a company that has a bold purpose and does meaningful work. At GoDaddy, we remain laser focused on helping entrepreneurs succeed and grow their businesses. We are a trusted partner to over 21 million customers who rely on us to help them soar during successes and lift them during challenges.

Our customers look to GoDaddy for multiple needs, confirming the value of our competitively differentiated brand, sage customer guidance and seamlessly intuitive experiences. We create value for customers through our unique combination of assets, and our customer-inspired innovation model exemplifies how we are truly partnering with our customers on their business journeys. All of this results in strong stockholder value creation, and our profitable model continues to scale.

As we look back at 2021, our unyielding acceleration of execution is what excites me the most. The integration of Poynt and the launch of our OmniCommerce offering are cornerstone moments in the growth of our Company, and we are eager to see the promising results still to come. We delivered strong growth in bookings, revenue and unlevered free cash flow in 2021, with the fourth quarter being GoDaddy's first quarter with over $1 billion in revenue. This would not be possible without the deep trust we have built with our customers who provide us the privilege of supporting them.

In 2022, we plan to continue executing on our strategic priorities: driving success in commerce through presence, supporting GoDaddy Pros and innovating in Domains. Our customers' commerce needs are increasingly interconnected, and we at GoDaddy are focused on enabling commerce on every surface for them. We are committed to continuing our pace of innovation, bringing important solutions to customers that increase loyalty, and driving progress across the entire industry. Our attractive growth algorithm drives durable top line growth, expanding margins, and robust cash flow with a disciplined approach to capital allocation.

This past February we shared our exciting vision and plans for 2022 and beyond at our Investor Day, and we were pleased to hear from many of our stockholders who share our enthusiasm for the path we have laid out. Going forward, as we execute against our strategy, you will hear further from us on our progress.

In closing, I want to reiterate my optimism and conviction in GoDaddy’s future. I look forward to continuing to work with our great team here, our customers and our stockholders. From all of us at GoDaddy, we thank you for your support, we appreciate your confidence in the business and we look forward to what is ahead.

| |

| | Best, |

| | | | |

| | AMAN BHUTANI |

| | Chief Executive Officer |

On behalf of the entire Board, I would like to thank you for your continued investment in and support of GoDaddy. As we execute our mission to empower entrepreneurs and make opportunity more inclusive for all, we are grateful for the confidence our stockholders continue to show in our long-term strategy to deliver profitable growth and create stockholder value.

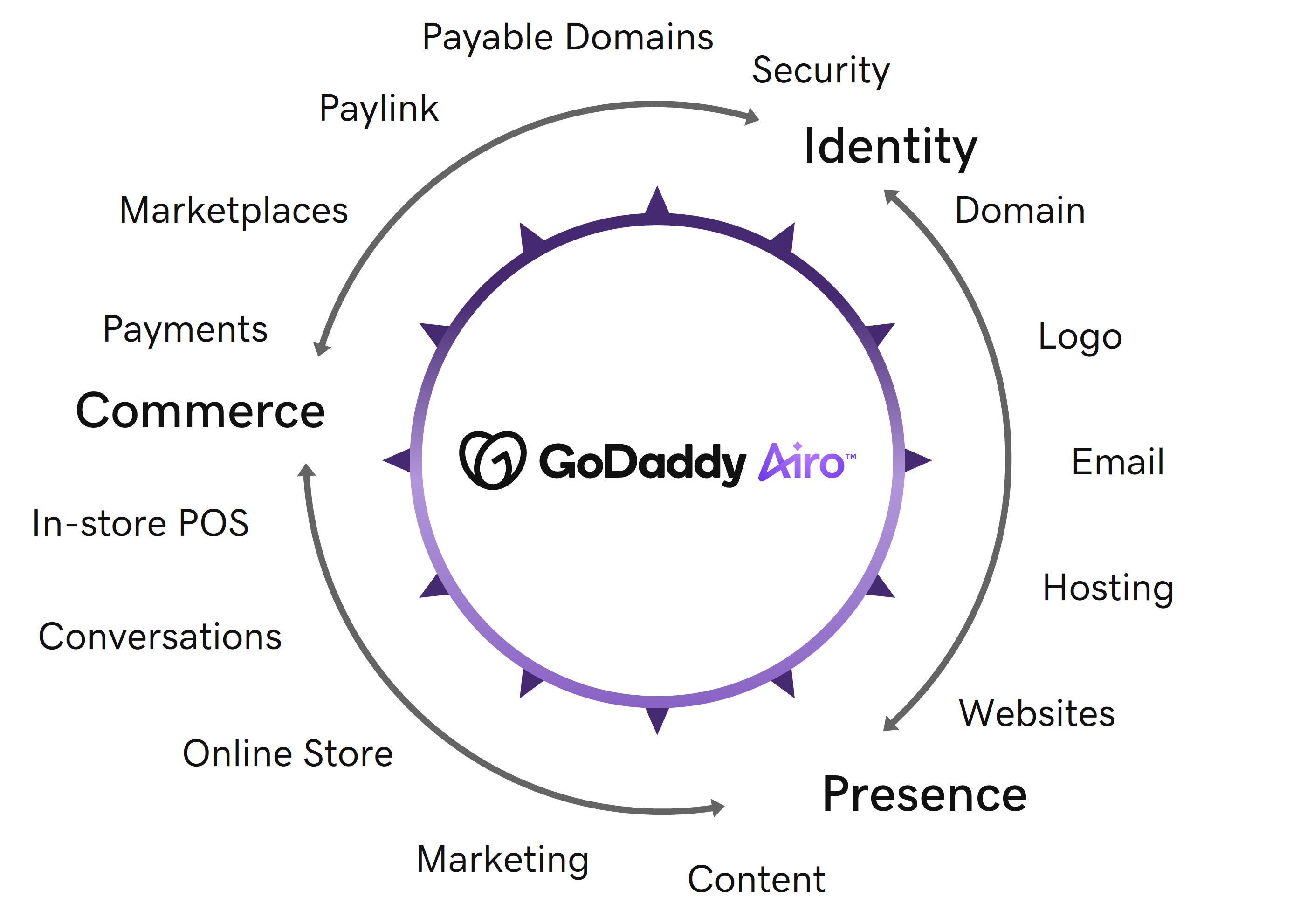

2023 was a pivotal year for GoDaddy. We continued to make significant strides in our multi-year effort to build a unified software platform and solidify our position as a one-stop shop for our 21 million customers as they grow and build their businesses digitally. These efforts are reflected in our strong financial and operational results for 2023, and our ability to deliver exciting new capabilities, such as the GoDaddy Airo™ experience, which proactively builds and grows our customers’ businesses with the power of AI.

I’ve often shared our perspective that having highly engaged Directors with a wealth of diverse expertise and experience is critical to the Board’s effective exercise of our oversight responsibilities. The power of this was evident in the way the Board exercised oversight and supported management and the team as they built GoDaddy Airo™, providing insights with respect to

product development, customer experience, go-to-market strategy and more. We also benefited from the strong contributions provided throughout the year by our newest independent Directors, Srini Tallapragada and Sigal Zarmi, who joined us in January 2023. As the Chair of GoDaddy’s Board, I would like to thank them and the entire Board for their relentless focus and continued dedication to GoDaddy’s vision and mission.

As always, the Board remains actively committed to strong corporate governance. I had the opportunity throughout 2023 to meet with many of our stockholders to understand their perspectives across a broad range of topics, including our corporate governance practices, Board composition and refreshment efforts, executive compensation program and business strategy, as well as our thoughtful approach to environmental and social priorities and initiatives. Stockholder feedback has provided important guidance and continues to be a key consideration in our Board and committee discussions. We are grateful for this input and remain committed to our engagement efforts.

As GoDaddy continues executing on its long-term strategy, I would like to take a moment to recognize how proud the

entire Board is of our employees and the management team whose hard work and unyielding dedication brings GoDaddy’s mission to life for our customers.

All of us at GoDaddy are excited about what is to come as we continue to advance our strategy, deliver long-term stockholder value, empower entrepreneurs and make opportunity more inclusive for all.

On behalf of the entire Board, I would like to once again thank you for your continued support of GoDaddy.

Best,

BRIAN SHARPLES

Board Chair

| | | | | | | | | | | | | | |

| | | 20222024 Proxy Statement | 1 |

| | | |

Notice of Virtual Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | | | | |

| Notice of Virtual Annual Meeting of Stockholders |

| | | | | | | | | | | | | | | | | |

| | | | | |

| DATE AND TIME: | | | VIRTUAL MEETING SITE: | | | WHO CAN VOTE: |

Wednesday,Thursday, June 1, 2022,6, 2024, 8:00 a.m. PDT | | www.virtualshareholder meeting.com/GDDY2022 | GDDY2024 | Stockholders of record on April 6, 202211, 2024 |

| | | | | |

Dear Stockholders of GoDaddy Inc.:

You are cordially invited to the 20222024 virtual annual meeting of stockholders (the “Annual Meeting”) of GoDaddy Inc., a Delaware corporation (“GoDaddy” or the “Company”). The Annual Meeting will be held on Wednesday,Thursday, June 1,20226, 2024 at 8:00 a.m. PDT and will be conducted virtually via live webcast at www.virtualshareholdermeeting.com/GDDY2022GDDY2024. You can attend the Annual Meeting online, vote your shares electronically and submit questions and view the Company’s list of stockholders during the Annual Meeting by logging in to the website listed above and using the 16-digit control number on your notice or the proxy card (the “Control Number”). We recommend you access the website a few minutes before the meeting to ensure that you are logged in when the meeting starts.

This virtual meeting format enables us to expand access to the meeting, improve communications and lower the cost to our stockholders, the Company and the environment. We believe virtual meetings enable increased stockholder participation from locations around the world. Additionally, given the continued heightened concerns around COVID-19, the virtual meeting format allows us to continue to proceed with the meeting while mitigating the health and safety risks to participants.

Items of Business:Business

At the Annual Meeting, stockholders will be asked to vote upon the following proposals:proposals listed below. Our Board recommends that stockholders vote for “FOR” each of the proposals at this Annual Meeting.

| | | | | | | | | | | | | | | | | |

| Proposal No. 1 | Proposal No. 2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Proposal No. 3 |

1

Election of three Class III and three Class III directors to serve until the 2025 annual meeting of stockholders and until their successors are duly elected and qualified, subject to earlier resignation, death resignation or removal | | 2

Advisory, non-binding vote to approve named executive officer compensation | | 3

Advisory, non-binding vote to approve the frequency of advisory votes on named executive officer compensation for one, two or three years

| | 4

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022 2024 |

| | | | | |

| FOR each director nominee | | | FOR | | | ONE YEAR | | | FOR |

| | | | | | | | | | |

5

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directorsPage 19 | | 6

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate certain supermajority voting requirements

| | 7

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate certain business combination restrictions set forth therein and instead subject the Company to the business combination restrictions of the Delaware General Corporation Law

| | 8

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate inoperative provisions and implement certain other miscellaneous amendmentsPage 75 |

| | | | | |

| Proposal No. 4 | Proposal No. 5 | |

| Approval of the GoDaddy Inc. 2024 Omnibus Incentive Plan | Approval of the GoDaddy Inc. 2024 Employee Stock Purchase Plan | |

| | | | | |

| FOR | | FOR | | |

| | | FOR

| | | FOR | | | FOR

We will also transact such other business as may properly come before the meeting, or any adjournment or postponement thereof.

How to Vote:Vote

If you are a stockholder of record, there are four ways to vote:

1.By Internet: You can vote your shares online atwww.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. PDTEDT on May 31, 2021June 5, 2024 (have your proxy card in handavailable when you visit the website).

2.By Telephone: You can vote your shares by calling 1-800-690-6903 toll-free (have your proxy card in handavailable when you call).

3.By Mail: You can vote your shares by completing, signing, dating and returning your proxy card in the postage-paid envelope provided (if you received printed proxy materials).

4.During the Virtual Meeting: You can vote your shares during the virtual Annual Meeting through live webcast at www.virtualshareholdermeeting.com/GDDY2022GDDY2024. You can attend the Annual Meeting online, vote your shares electronically and submit questions online during the Annual Meeting by logging in to the website listed above and using your Control Number. We recommend that you access the website a few minutes before the meeting to ensure that you are logged in when the meeting starts.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| INTERNET www.proxyvote.com | | TELEPHONE 1-800-690-6903 | | MAIL Complete and mail your proxy card | | DURING THE VIRTUAL MEETING www.virtualshareholder meeting.com/GDDY2024 |

| | | | | | | |

If you are a street namestreet-name stockholder, you will receive voting instructioninstructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. You may also attend and vote the Annual Meeting using the control number on your voting instruction form.

Our Board of Directors (the “Board”) has fixed the close of business on Wednesday,Thursday, April 6, 202211, 2024 as the record date for the Annual Meeting. Only stockholders of record on Wednesday,Thursday, April 6, 202211, 2024 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Wednesday, June 1, 2022. GoDaddy’s Proxy Statement and 2021 Annual Report are available at www.proxyvote.com.

YOUR VOTE IS IMPORTANT. Whether or not you plan to virtually attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented.

This notice and Proxy Statement is first being mailed or made available on the Internet to stockholders on or about [__], 2022.

We appreciate your continued support of GoDaddy Inc. and look forwardare excited to either greetinggreet you at the Annual Meeting or receivingreceive your proxy.

| | | | | | | | | | | | | | | | | | | | | | | |

| INTERNET

http://www.proxyvote.com

| | TELEPHONE

1-800-690-6903

| | MAIL

Complete and mail your proxy card

| | DURING THE VIRTUAL MEETING

www.virtualshareholder meeting.com/GDDY2022

|

By Order of the Board of Directors,

MICHELE LAUJared F. Sine

Chief Strategy & Legal Officer and Corporate Secretary

Tempe, Arizona

[__], 2022April 25, 2024

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on Thursday, June 6, 2024. GoDaddy’s Proxy Statement and 2023 Annual Report are available at www.proxyvote.com. YOUR VOTE IS IMPORTANT. Whether or not you plan to virtually attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented.This notice and Proxy Statement is first being mailed or made available on the Internet to stockholders on or about April 25, 2024. |

|

| | | | | | | | | | | | | | |

| | | 20222024 Proxy Statement | 3 |

| | | |

[Page intentionally blank]

Table of Contents

| | | | | | | | | | | | | | |

| | | 20222024 Proxy Statement | 5 |

| | | |

[Page intentionally blank]

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

ThisThe following sections about our Company and our performance, as well as our proxy summary, include highlights of information that is contained elsewhere in this Proxy Statement. You should carefully read this Proxy Statement in its entirety before voting, as this summary doesthese sections do not contain all of the information that you should consider.

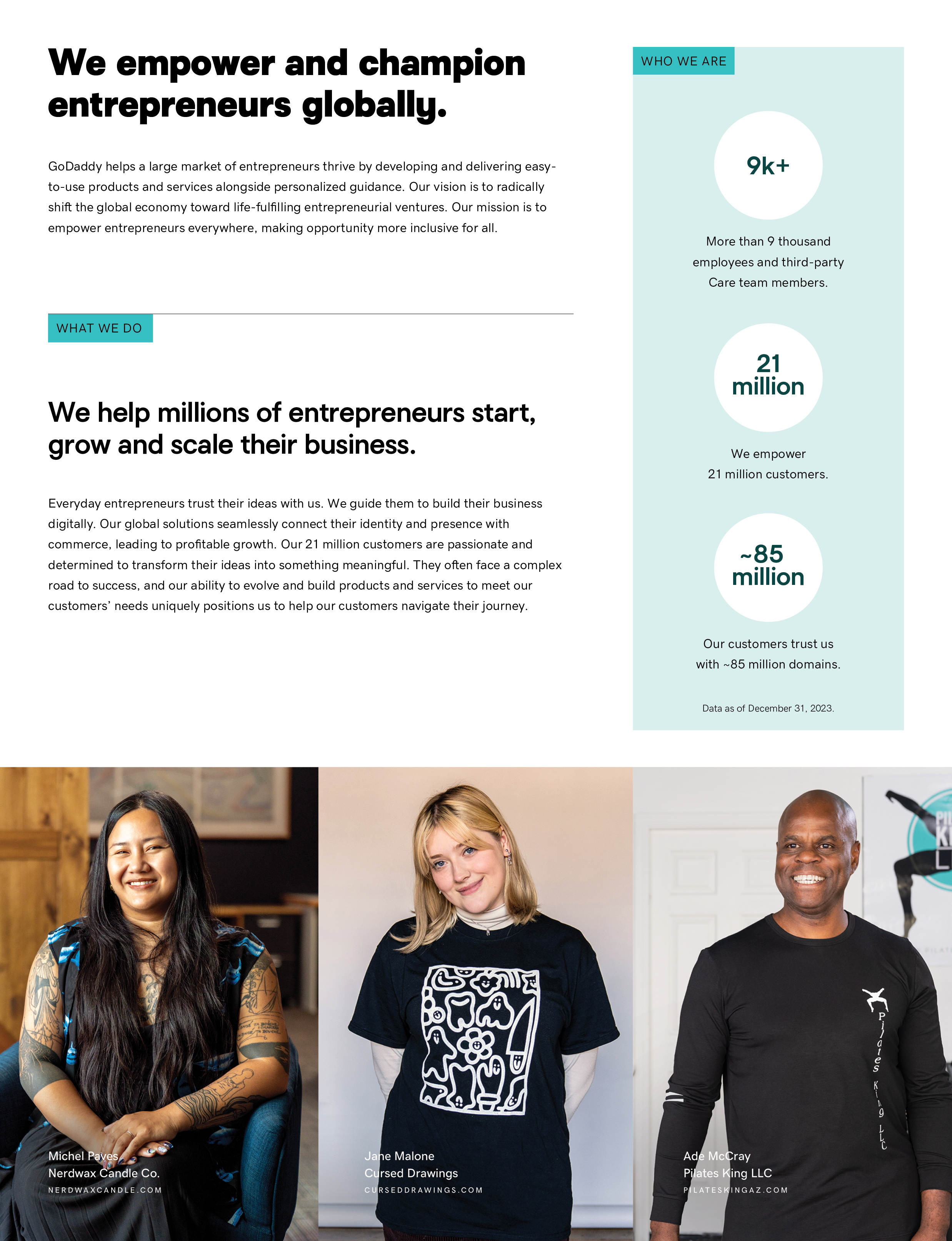

Voting MattersOur Company

Stockholders will be askedGoDaddy is a global leader serving a large market of entrepreneurs, developing and delivering easy-to-use products in a one-stop shop solution alongside personalized guidance. We serve small businesses, individuals, organizations, developers, designers and domain investors. Our vision is to vote onradically shift the following matters at the Annual Meeting:global economy toward life-fulfilling entrepreneurial ventures. Our mission is to empower entrepreneurs everywhere, making opportunity more inclusive for all. We are passionate about our mission and honored that entrepreneurs trust their ideas with us.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1Our 21 million customers are passionate and determined to transform their ideas into something meaningful. They often face a complex road to success, and our ability to evolve and build products to meet our customers’ needs uniquely positions us to help our customers navigate their journey.

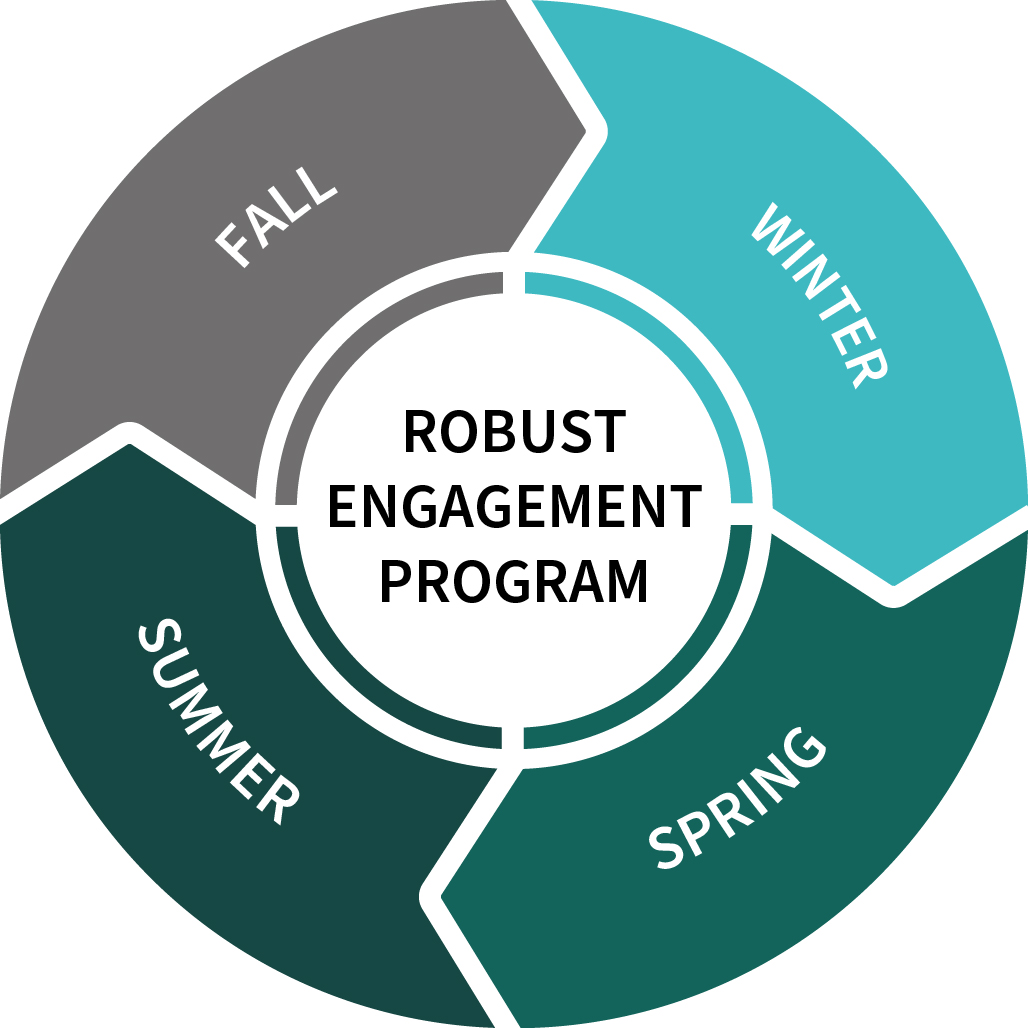

ElectionOur customers’ journeys are non-linear, and we design our services to help across all aspects of their business. Each phase in the journey can be iterative in nature; customers are constantly revisiting different stages of their entrepreneurial experience to improve and grow across what we call the “Entrepreneur's Wheel.” The Entrepreneur's Wheel focuses on three Class I directorsareas: identity, presence and commerce. As the needs of our customers change and expand, we evolve our products and services to serve untilmeet them where they are on the 2025 annual meeting of stockholders and until their successors are duly elected and qualified, subject to earlier death, resignation or removalEntrepreneur's Wheel.

| |

Our stable and durable business model is driven by strong brand recognition, efficient customer acquisition, high customer retention rates and increasing lifetime spend of our customers. In each of the five years ended December 31, 2023, our customer retention rate was approximately 85% and, in 2023, we had over 1.5 million customers who each spent more than $500 a year on our product offerings. We believe the breadth and depth of our product offerings, seamless ease-of-use in a one-stop shop and the high-quality, personalized guidance and responsiveness from GoDaddy Guides continue to build strong customer relationships leading to our high customer retention rates.

| | | | | | | | |

221 million

Advisory, non-binding vote to approve named executive officer compensationCustomers1

| | 3~85 million

Advisory, non-binding vote to approve the frequency of advisory votesDomains Under Management1

|

1As of December 31, 2023.

| | |

|

Additional information about our Company can be found on named executive officer compensation for one, two or three years | | 4

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022corporate website and in our 2023 Annual Report. Please visit aboutus.godaddy.net/about-us and our investor relations site aboutus.godaddy.net/investor-relations.

|

| FOR each director nominee

| | | FOR | | | ONE YEAR | | | FOR |

PAGE 16 | | PAGE 37 | | PAGE 66 | | PAGE 67 |

|

5

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors

| | 6

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate certain supermajority voting requirements

| | 7

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate certain business combination restrictions set forth therein and instead subject the Company to the business combination restrictions of the Delaware General Corporation Law

| | 8

Approval of an Amendment to the Company’s Amended and Restated Certificate of Incorporation to eliminate inoperative provisions and implement certain other miscellaneous amendments

|

| FOR | | | FOR | | | FOR | | | FOR |

PAGE 70 | | PAGE 72 | | PAGE 74 | | PAGE 76 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

Summary | Board and

Governance Matters | | Executive

Compensation | | Audit

Matters | | Other Management

Proposals | | Other

Information |

| | | | | | | | | | |

Our EvolutionAbout

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2015 |  GoDaddy | | Initial Public Offering | | GoDaddy became a public company in 2015 and has experienced significant change over the last several years. As we continue to evolve, we are committed to ongoing engagement with our stockholders and enhancing our governance, compensation and environmental sustainability practices. Since 2020, we have made multiple changes, and with stockholder feedback, the pace of change has accelerated over the course of the last 18 months. | |

| | 2018 |  Summary | | Cease Controlled Company Status | | |

| | 2019 | | Aman Bhutani Appointed CEO | Former Sponsors Exit Stock | Engagement Roadshow Begins | | | |

| | | | | | | | | | | |

|

|

| 2019 | |  Restructured NEO compensation program beginning with the 2020 program•Removed stock options from the long-term incentive program

•Increased the percentage of the long-term incentive program that is performance-based to 50% of the overall long-term incentive award

•Eliminated overlapping metrics between the annual and long-term incentive plans in order to create incentives over a wide spectrum of corporate objectives

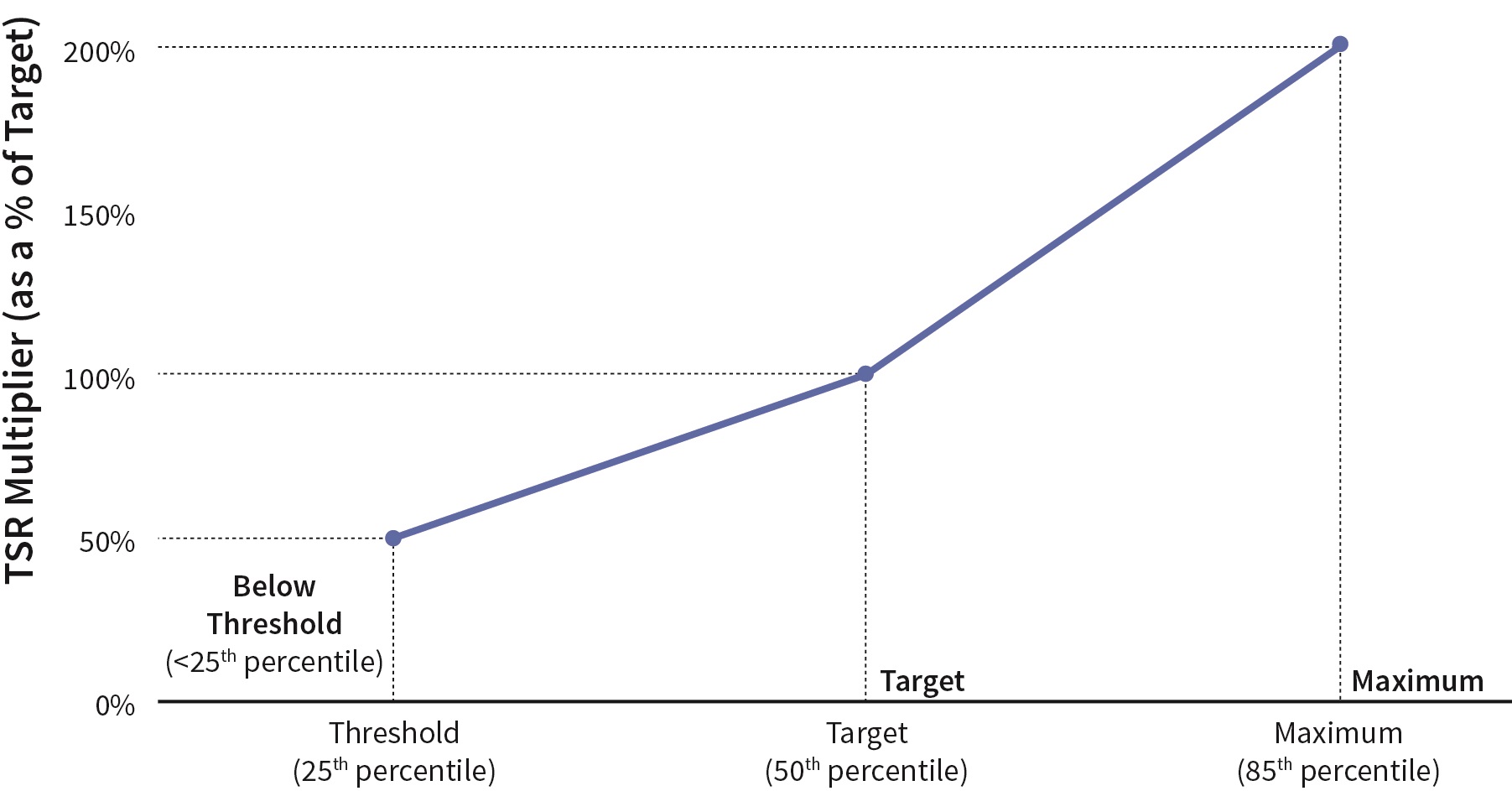

•Incorporated a relative total stockholder return performance metric into the long-term incentive program to further enhance the link between the interests of our executives and stockholders

Affiliates of Kohlberg Kravis Roberts & Co. L.P. and Silver Lake Partners sell the remainder of their positions in GoDaddy |

|

| | | |

| 2020 | |  Approved a largely performance-based go-forward compensation package for our CEO in 2021, the first year he was eligible for the new compensation package following his 2019 new hire package Amended Stock Ownership Guidelines to (i) adopt guidelines applicable to our executive officers and (ii) enhance those already in place for non-employee directors Continued annual stockholder outreach with emphasis on proposed governance enhancements |

| | | |

| | | |

| 2021 | |  Bolstered our annual stockholder engagement program with further emphasis on compensation program enhancements Board Approved Governance Enhancements•Management proposal to declassify the board at the Annual Meeting

•Management proposal to eliminate the supermajority vote requirement at the Annual Meeting

•Majority vote standard in uncontested director elections

•Guidelines related to director service on other public company boards

•Enhanced anti-pledging policy

Executed management team refreshment committee leadership updatesGovernance•Reconstituted our Board Committees including rotating the Audit and Finance Committee and the Nominating and Governance Committee ChairsMatters

| | | Executive •Assigned new oversight responsibilities of environmental, social, governmental and corporate governance developments and disclosures to our Nominating and Governance CommitteeCompensation

| | | Audit •Memorialized oversight responsibilities over human capital management to our Compensation and Human Capital Committee

Published inaugural Sustainability ReportMatters |

| | | |

| | | |

| 2022 | |  Enhanced executive compensation program disclosure•Enhanced disclosure of changes to and parameters set around our compensation programs, including additional rationale and context for changes made

•Enhanced disclosure relating to caps on short-term incentive program awards and achievement of individual performance goals under the short-term incentive program

•Disclosed the forward looking qualitative scorecard metrics for our CEO’s short-term incentive scorecard

Submitted governance enhancements for a vote at the Annual Meeting Published seventh consecutive Diversity and Parity Annual Report |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proxy

Summary | | Board and

Governance Matters | | Executive

Compensation | | Audit

Matters | | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Company Highlights and Updates

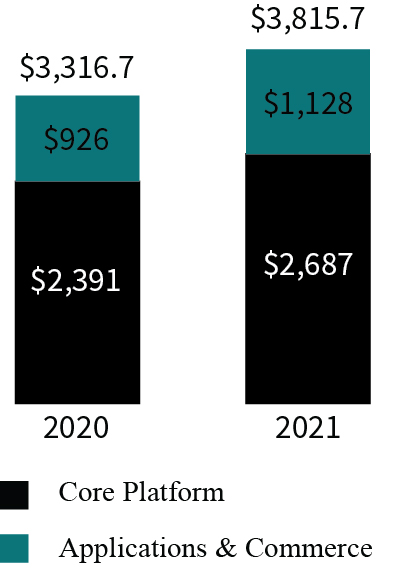

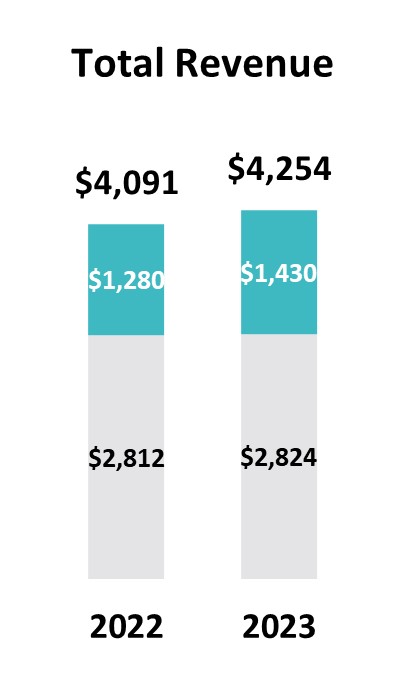

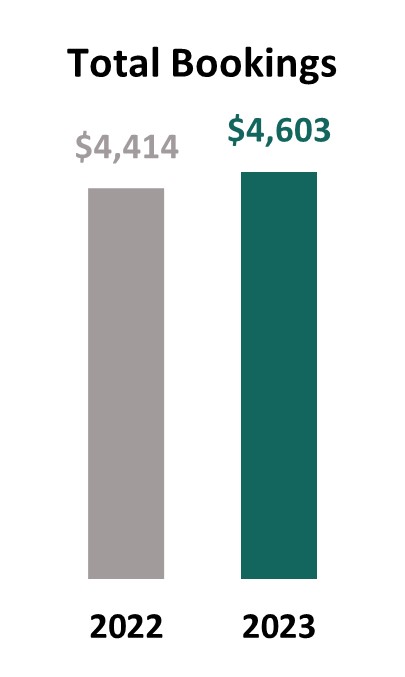

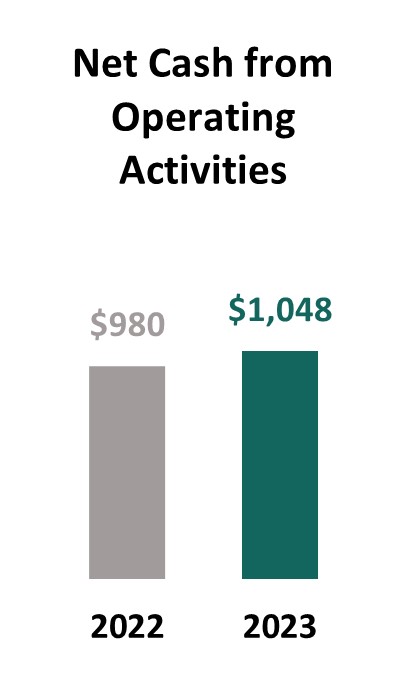

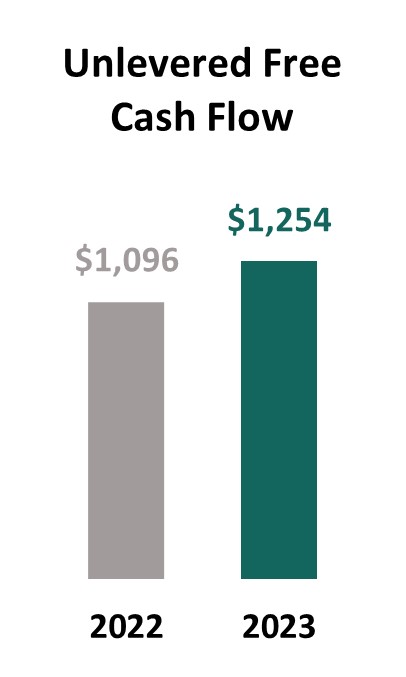

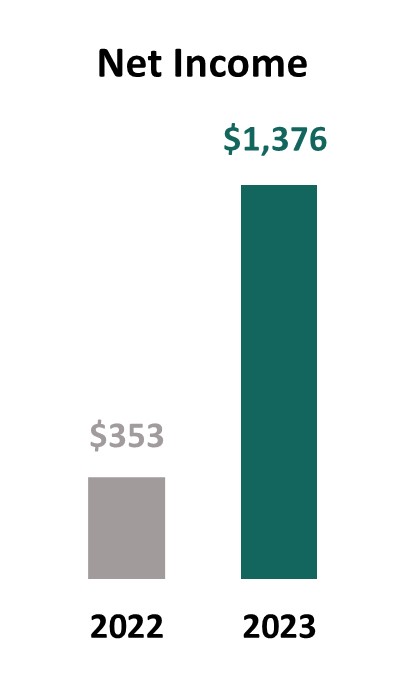

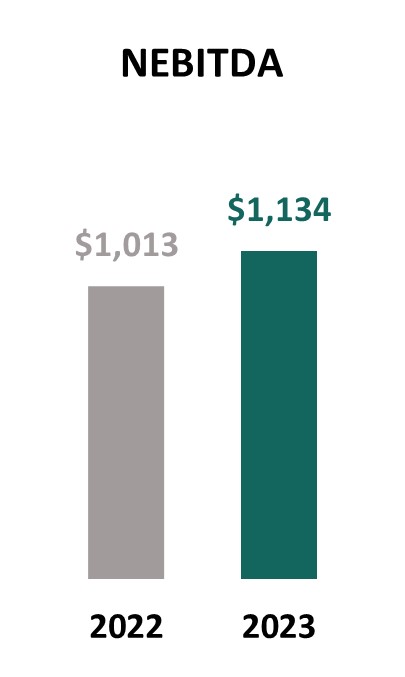

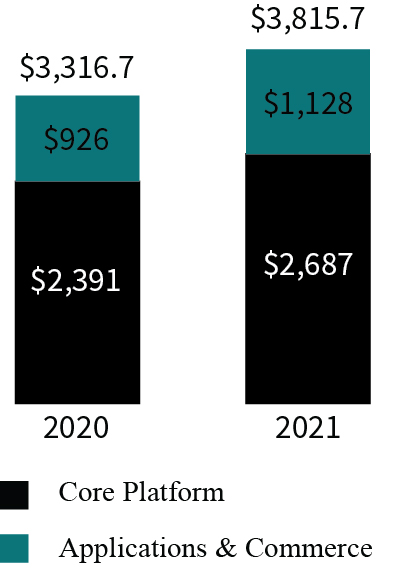

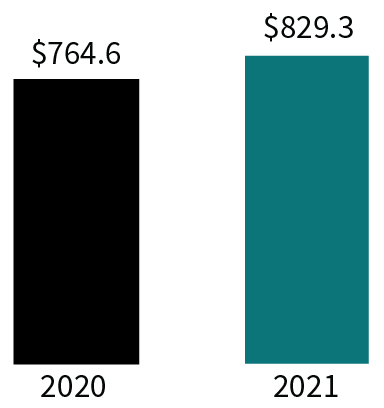

2021 Company and Performance2023 Financial Highlights

At GoDaddy, we believe our vision and mission are more important today than ever before. We believe the largest opportunity for our customers to grow their businesses is to engage and sell to their customers in a seamless manner online and offline. We offer our customers seamless and intuitive products combined with sage guidance by bringing together each customer’s Digital Identity, their domain name, and their commerce needs to create a Connected Commerce experience. This Connected Commerce experience supports their Ubiquitous Presence by allowing our customers to seamlessly engage and sell to their customers online, on major marketplaces and social media platforms, and offline, in their physical stores.

In 2021,2023, we continued to expand our differentiated set of solutions with a goal of partnering with customers in this dynamic environment to help them build their businesses. We are uniquely positioned to bring together these three core areas – Digital Identity, Ubiquitous Presencedemonstrated strong operational execution and Connected Commerce – given our industry leading position in Digital Identity with 84 million domains under management, a sophisticated online presence and hosting provider representing approximately 12% of the application-based websites in the world and a scaled payments company processing approximately $26 billion of gross merchandise volume in 2021. We are excited by the accelerationfinancial performance while also making significant progress in our pacemission of executionempowering entrepreneurs everywhere, making opportunity more inclusive for all. Our strategy centers on creating customer value and innovation going into 2022.driving profitable growth resulting in compounding free cash flow and long-term stockholder value.

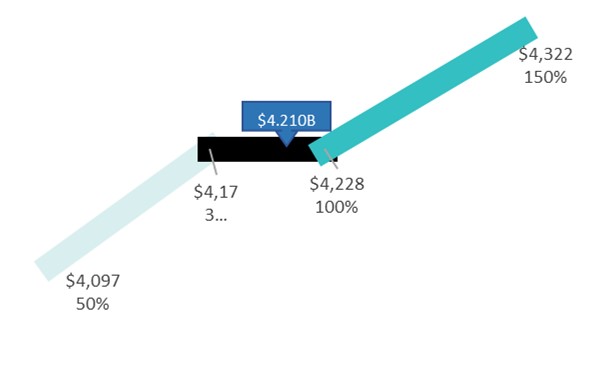

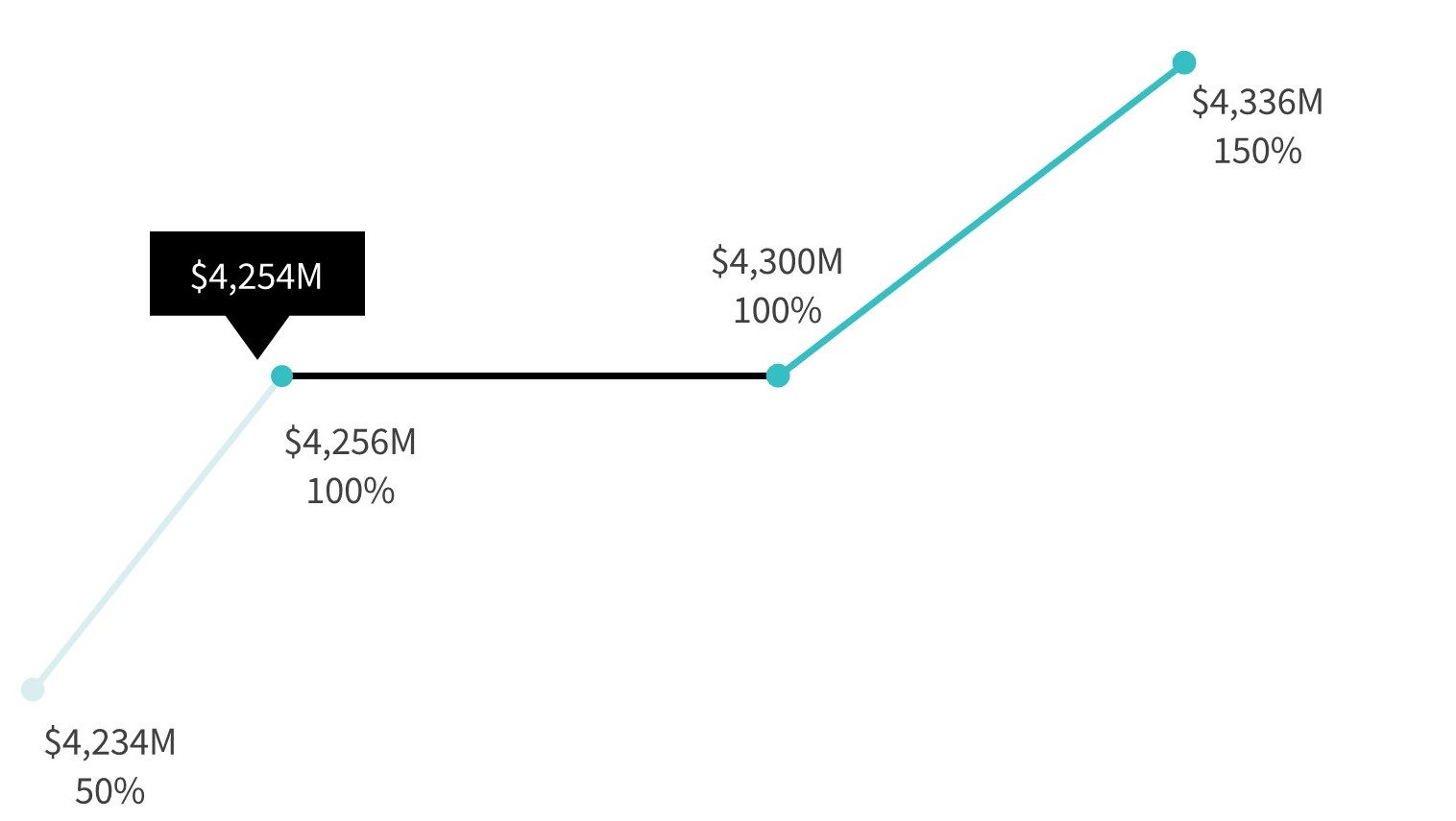

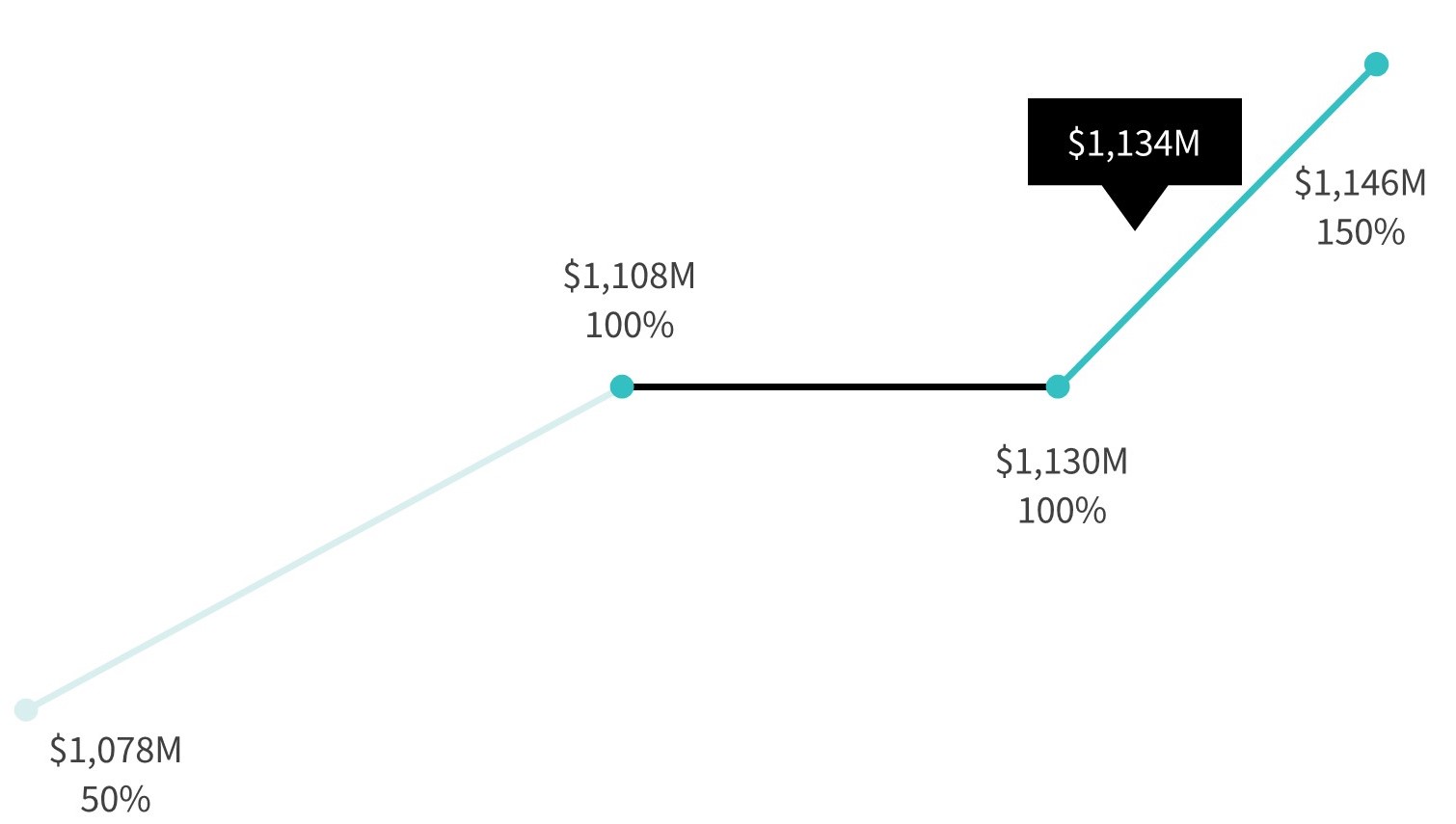

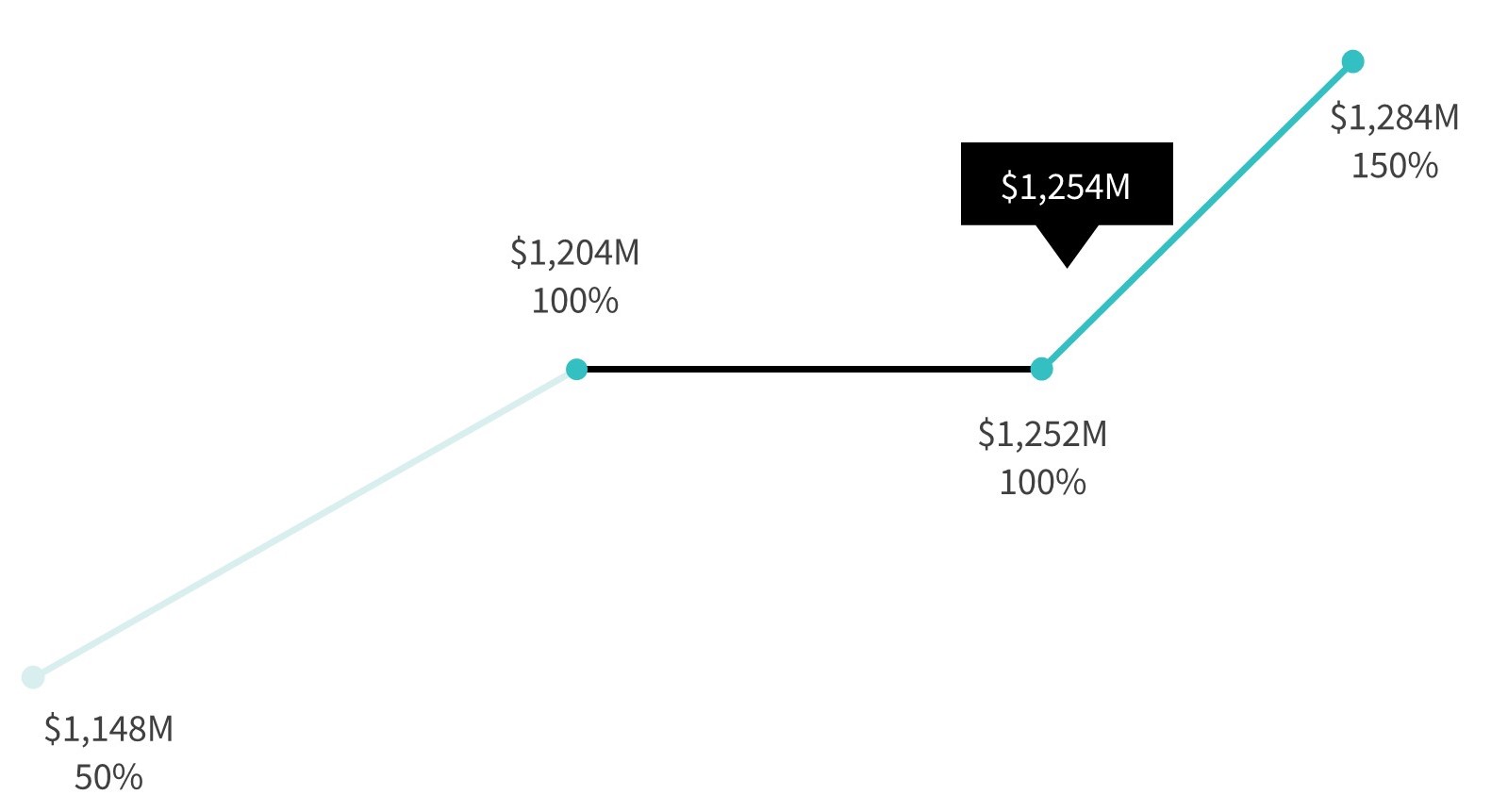

We focused on these core areas across the business in 2021 and delivered a year of successful results. In February 2022 we introduced two new revenue pillars: Applications & Commerce & Core Platform – our performanceOur financial highlights from 2021, including these two new revenue pillars,2023 are presented below:

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Total Revenue | | | | Bookings | | | | Operating Cash | | | | Unlevered Free Cash Flow | |

|

| | | | | | | | | | | | | | |

|   Core Platform Segment Core Platform Segment Applications & Commerce Segment Applications & Commerce Segment | | | | | | | | | | | | | |

| | | | | | | | | | | | *All figures are in millions | |

| | | | | | | | | | | | | | |

| | | | | |

| | | | | |

Total revenue increased 4% year-over-year, and 5% on a constant currency basis1 | Revenue increased 15% to $3,815.7 million in 2021 from $3,316.7 million in 2020, with the fourth quarter generating over $1 billion in quarterly revenue for the first time in the Company’s history.Total bookings2 grew 4% year-over-year, and 5% on a constant currency basis1 | | | | Bookings grew 12.1% to $4,231.7 million from $3,775.5 million in 2020.1 | | | | We demonstrated continued strong cash flow, with growth in netNet cash provided by operating activities year over year, generating $829.3 million in 2021.up 7% year-over-year | Unlevered free cash flow3 grew 14% year-over-year | Net income grew 290% year-over-year4 | | Unlevered Free Cash Flow of 16% year over year, generating $960.0 million in 2021.2 | |

| | | | | | | | | | | | | | NEBITDA3 grew 12% year-over-year, representing a 27% NEBITDA margin for 20233 |

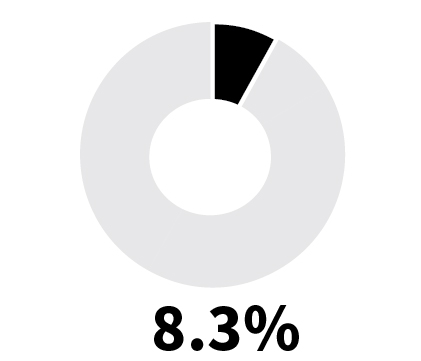

In 2023, we announced a $1 billion increase to our multi-year share repurchase program, such that our total approved authority under the program is $4.0 billion of shares through 2025. From January 1, 2022 through February 1, 2024, we repurchased 34.2 million shares of our common stock for an aggregate purchase price of $2.6 billion, and an average price per share of $74.99. These repurchases represent a gross reduction of approximately 20% in fully diluted shares from those outstanding as of December 31, 2021. | | | | | |

$4 billion multi-year share repurchase program | 34.2 million shares repurchased5 |

1 Bookings is notFor a financial measure prepared in accordance with GAAP. For information on how we compute non-GAAP financial measures and other operating metrics and reconciliation to the most directly comparable financial measures prepared in accordance with GAAP,discussion of constant currency, please refer to “Appendix A —A—Operating and Business Metrics, Non-GAAP Financial Information and Reconciliations” in this Proxy Statement.

2 Unlevered Free Cash FlowTotal bookings is not a financial measure prepared in accordance with GAAP.an operating metric. For information on how we compute non-GAAP financial measurestotal bookings and other operating metrics, and reconciliation to the most directly comparable financial measures prepared in accordance with GAAP, please refer to “Appendix A —A—Operating and Business Metrics, Non-GAAP Financial Information and Reconciliations” in this Proxy Statement.

3Unlevered free cash flow, Normalized EBITDA (NEBITDA) and NEBITDA margin are not financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP). For a reconciliation between each non-GAAP financial measure and its most directly comparable GAAP financial measure, please refer to “Appendix A—Operating and Business Metrics, Non-GAAP Financial Information and Reconciliations” in this Proxy Statement.

4Net income for the year ended December 31, 2023 included (i) $90.8 million in restructuring and other charges and (ii) a $971.8 million benefit for income taxes primarily due to a $1,014.0 million release of the majority of our domestic valuation allowance.

5Shares repurchased as of February 1, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Through innovation and experimentation, we have developed and operate the largest domain aftermarket and we continue to make great strides2023 Business Highlights

Below is a summary of some of our key business highlights in advancing our registry business as well. We ended the year with a significant out-performance in aftermarket driven primarily by increased market demand, average sales price and volume of sales. Additionally, we announced a multi-year $3 billion share repurchase target and executed a $750.0 million accelerated share repurchase program in February 2022, delivering on our commitment to continue to enhance stockholder value.2023:

We are pleased with our 2021 results, and with GoDaddy’s progress against our strategy. We are excited by the momentum behind our biggest product release yet with our OmniCommerce offering, showing promising early signals of adoption. We are committed to continuing our pace of innovation, bringing simple, easy-to-use solutions to customers that drive performance and deliver durable top line and profitable growth, robust cash flow with a focus on disciplined capital allocation. | | | | | |

| |

| |

| Innovating in Domains and Productivity | •Introduced in the U.S. our GoDaddy Airo™ experience, which proactively builds and grows our customers’ businesses with the power of AI. •Expanded bundled offerings to increase product attach for both new and existing customers, including initiation of bundling GoDaddy Airo™ with domain purchases in the U.S. •Released Payable Domains, branded pay links that create a secure checkout page, shareable via a link, that allow anyone to begin accepting payments the moment they purchase a new U.S.-based domain name, even if they do not yet have a website or online store. •Integrated aftermarket “List for Sale” feature to registrar partners. |

| |

| |

| |

| |

| Driving Commerce Through Presence | •Implemented powerful generative AI tools into Websites + Marketing, helping microbusinesses run their business and manage their site through auto-generated online store product descriptions, customer service messages and Instagram and Facebook ads. •Continued to build strong traction in commerce adoption with both new and existing customers, driving significant gross payment volume growth. •Added new reports for merchants to assist with taxes, fees and payouts. •Launched Apple’s Tap-to-Pay in the GoDaddy mobile app and GoDaddy Payments in Canada. •Integrated GoDaddy Conversations with Google’s Business Messages, allowing entrepreneurs using Websites + Marketing plans to receive messages from consumers using Google Search and Maps. |

| |

| |

| |

| |

| Delivering for GoDaddy Pros | •Accelerated our innovation as we progressed toward unifying our hosting platform under a single technology stack. •Took proactive steps to rationalize our hosting business and integrate or divest certain underperforming acquired hosting assets and brands. •Reduced the complexity of launching and managing WordPress sites with Managed WordPress by providing a fully managed platform that delivers fast performance and AI-powered site creation. •Added more capabilities to our Managed WooCommerce Stores offering. |

| |

| | |

|

Additional information about our business and financial results can be found in our 2023 Annual Report and our other SEC filings. Please visit aboutus.godaddy.net/about-us and our investor relations site aboutus.godaddy.net/investor-relations. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| About GoDaddy | | | Proxy Summary | | | Board and Governance Matters | | | Executive Compensation | | | Audit Matters | | | Other Management Proposals | | | Other Information |

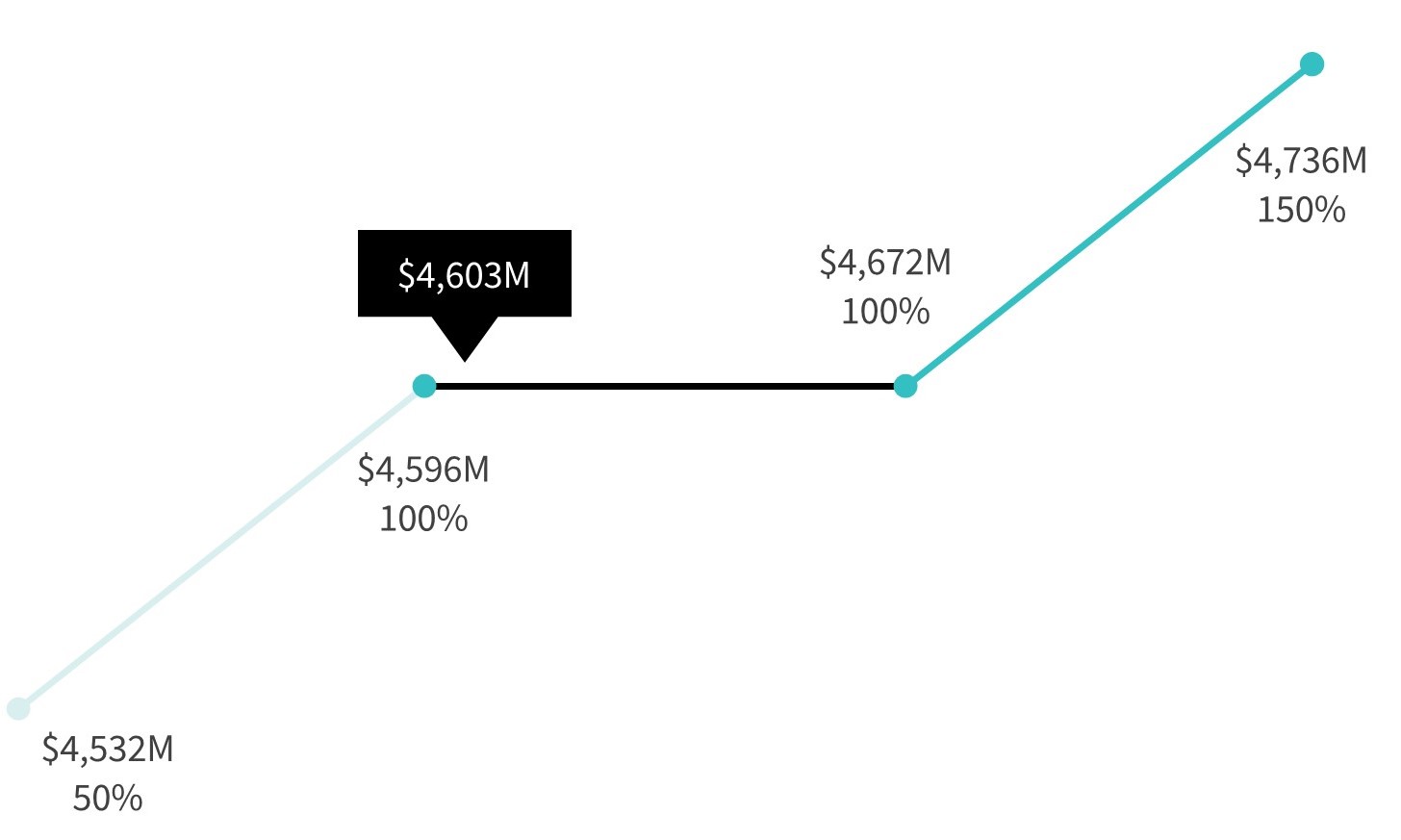

2024 Investor Day Highlights

In February 2022,March 2024, we hosted a virtualan investor day where we provided insights on how our strategy empowers our customers to succeed throughout the entrepreneur’s journey by creating connections between digitalguiding them to build their business digitally and seamlessly connecting their identity ubiquitousand presence and connected commerce products.with commerce. Our investor day highlights1 included:

| | | | | | | | | | | | | | |

| | | | |

| Customer and Product Strategy | | | New Revenue Pillars | Profitable Growth Strategy |

| | |

We discussed our strategy to attract new high-intent customers and increase engagement with our large and loyal current loyalcustomer base by showcasing our one-stop shop solution, including enabling our GoDaddy AiroTM experience across the entire Entrepreneur’s Wheel to fully unlock the power of more than 21+ million customers by attaching more products through integrated, easy-to-use solutions for small and mid-sized businesses. For example, we are excited to introduce Payable Domains this year, which will allow GoDaddy domain customers to take payments immediately.our software platform. | | We introduced two new revenue pillars,emphasized our focus on driving free cash flow and NEBITDA margin expansion by growing our higher-margin Applications & Commerce segment, leveraging our unified software platform, managing our cost structure and Core Platform,continuing to assist the financial community in better understandingexpand our use of AI and tracking the Company’s progress against its growth-focused areas.automation. |

| | | | |

| Capital Allocation Strategy | | | Three-Year Financial Targets | |

| | |

We emphasized a balanced approach to capital allocation, focused on unlocking meaningful value creation through investment in the business while also returninga returns-based approach to capital to stockholders.deployment. | | We provided three-year financial targets to help investors and analysts model expectations for our business over the long term. |

The feedback from investor day was positive. We believe that stockholders were excited about our customer and product strategy, new revenue pillars, and the long-term strategy and multi-year financial targets that we provided. We appreciate all the feedback and remain eager to continuing to build relationships with our stockholders in 2022.3

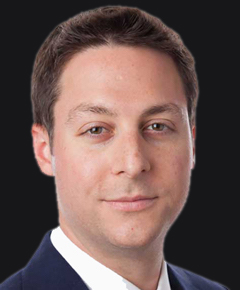

GoDaddy Leadership Team Updates

During the first half of 2021, our Chief Executive Officer, Aman Bhutani, along with our Board and management, embarked on a coordinated process to identify new members for our executive team. The Board and management interviewed internal and external candidates and weighed many factors, including the individual’s passion for the Company’s vision and mission, extraordinary skills, expertise, experience and demonstrated leadership strength. We also remained committed to the Company’s goals of maintaining a diverse leadership team and ensuring a strong cultural fit. At the culmination of the search, the Company was thrilled to appoint Mark McCaffrey as our Chief Financial Officer, effective June 2, 2021 and Michele Lau as our Chief Legal Officer and Corporate Secretary, effective July 12, 2021.

In addition, in the second half of 2021, our Board appointed Roger Chen as our Chief Operating Officer, effective January 3, 2022. Mr. Chen, who has been with the Company since 2015, was previously the President of GoDaddy’s Domain Registrars and Investors Business.

We believe these appointments are integral to the current and future success of GoDaddy, and we have tremendous confidence that these leaders share our Company’s passion for empowering our customers and will help deliver against our priorities and strategy.

More information about all our executive officers is available on page 34.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Mark McCaffrey

Chief Financial Officer

| | Michele Lau

Chief Legal Officer and Corporate Secretary

| | | Roger Chen

Chief Operating Officer

|

31The information we provided on investor day speaks only as of the date of the presentation, and we do not undertake any obligation to update the information, whether as a result of new information, future events, or otherwise.otherwise except as required by law. The presentation also contained forward-looking information that is subject to risks and uncertainties, and the results may differ materially from expectations.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Our Board of DirectorsSustainability Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Age | Independent | Director Since | Board Committees |

| Name and Principal Occupation | AFC | CHCC | NGC |

| CLASS I | | | | | | | |

| Aman Bhutani Chief Executive Officer, GoDaddy | 45 |

| 2019 | | | |

| Caroline Donahue Former Executive Vice President and Chief Marketing and Sales Officer, Intuit | 61 | | 2018 | • | • | |

| Charles Robel Former GP and Chief Operating Officer, Hummer Winblad Venture Partners | 72 | | 2014 | • | | |

| CLASS II | | | | | | | |

| Mark Garrett Former Executive Vice President and Chief Financial Officer, Adobe | 64 | | 2018 | c | | |

| Ryan Roslansky Chief Executive Officer, LinkedIn | 44 | | 2018 | | | • |

| Lee Wittlinger Managing Director, Silver Lake Partners | 38 | | 2014 | | | • |

| CLASS III | | | | | | | |

| Herald Chen President and Chief Financial Officer, AppLovin | 52 | | 2014 | • | | |

| Leah Sweet Former Senior Vice President, PayPal | 53 | | 2020 | | • | c |

| Brian Sharples Co-founder and Former Chairman and Chief Executive Officer, HomeAway | 61 | | 2016 | | c | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | AFC - Audit and Finance Committee | | | | | |

| | | | | | | |

| c – Chair • – MemberCUSTOMERS

We empower entrepreneurs everywhere and make opportunity more inclusive for all | | | EMPLOYEES We build a culture that values diversity and prioritizes the importance of making opportunity inclusive for all | | | OPERATIONS We reduce our environmental impact, operate our business ethically and manage risk appropriately |

| | CHCC - Compensation and Human Capital Committee | | | | |

| NGC - Nominating and Governance Committee | | | | | |

OUR SUSTAINABILITY PRIORITIES AND INITIATIVES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

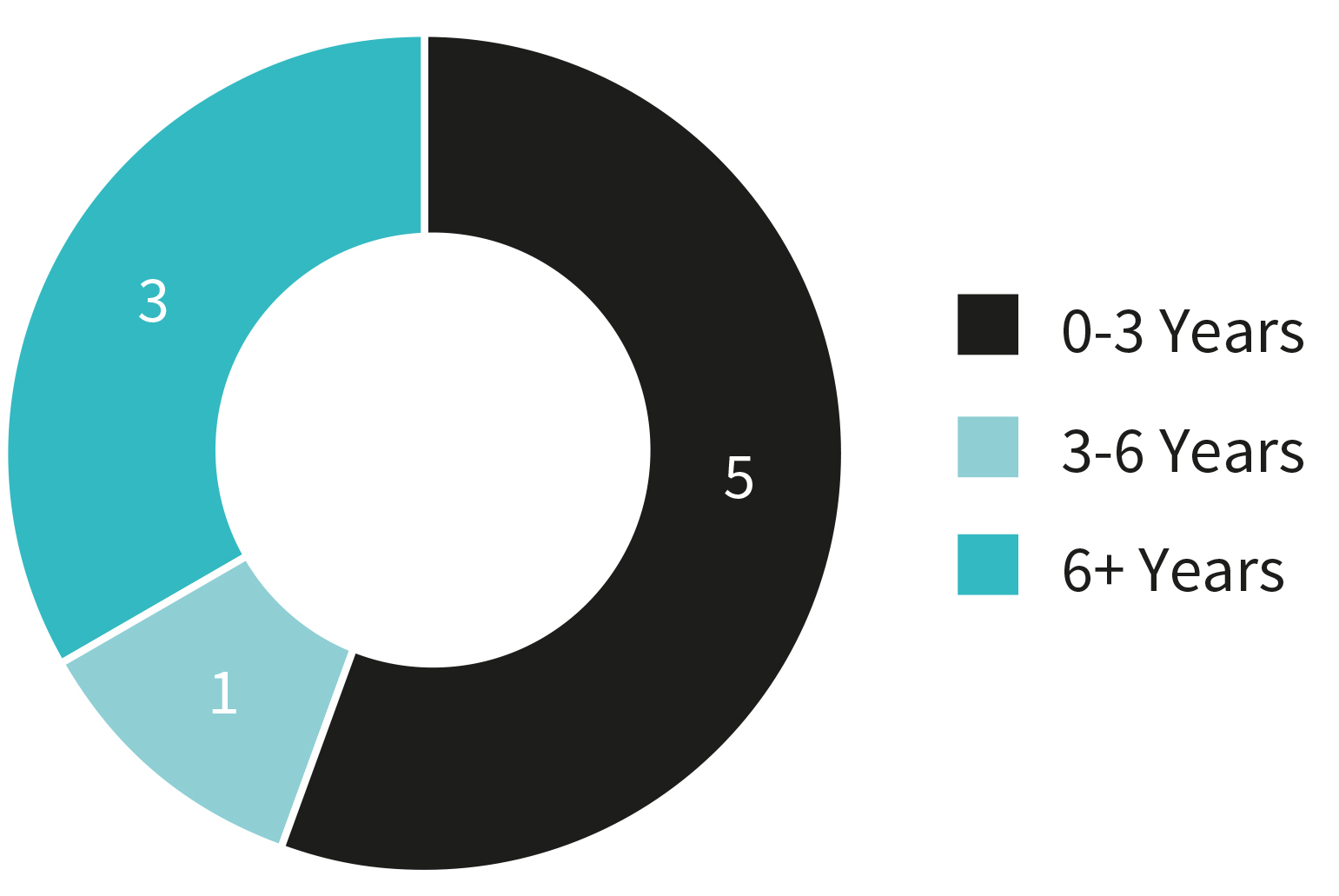

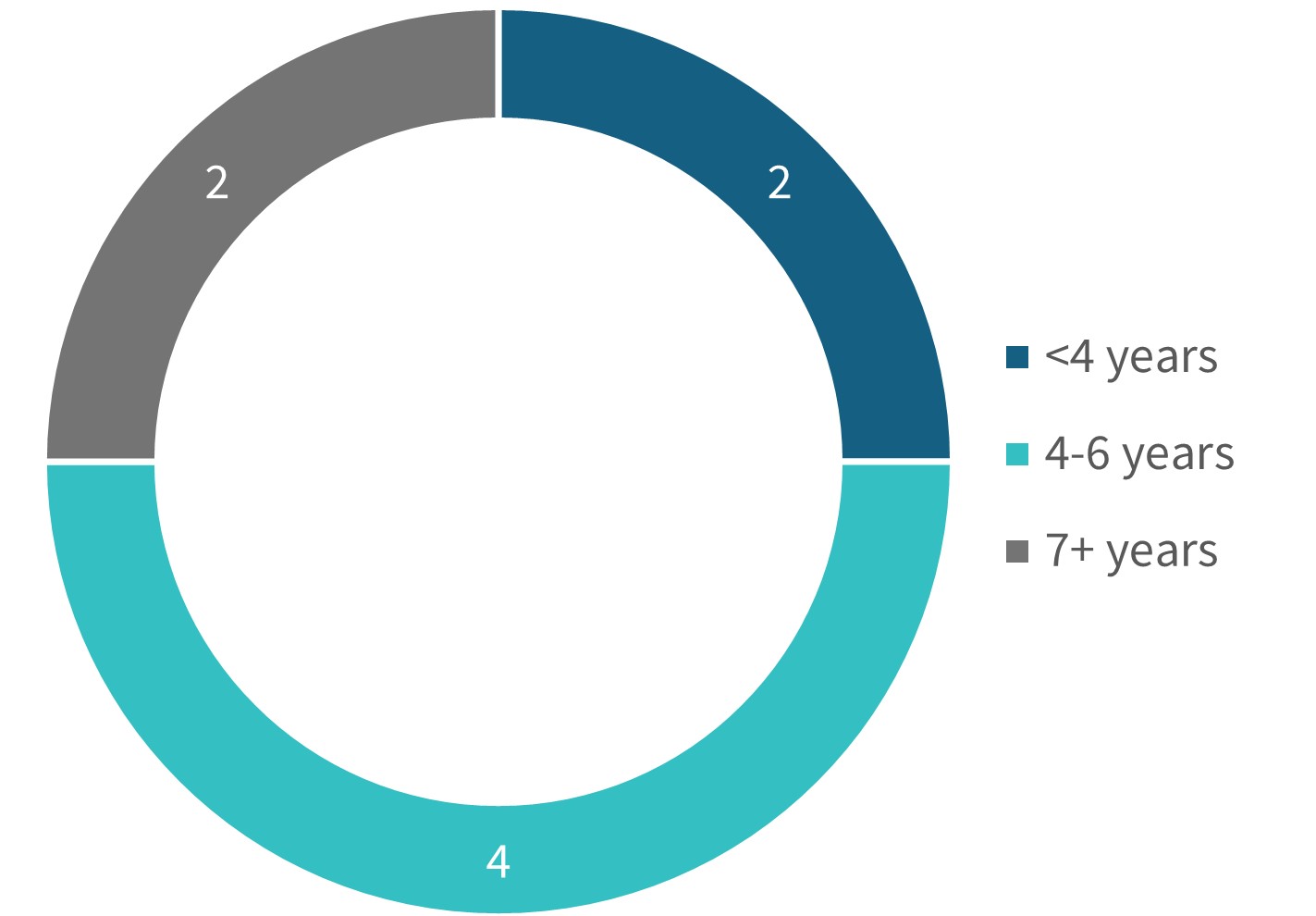

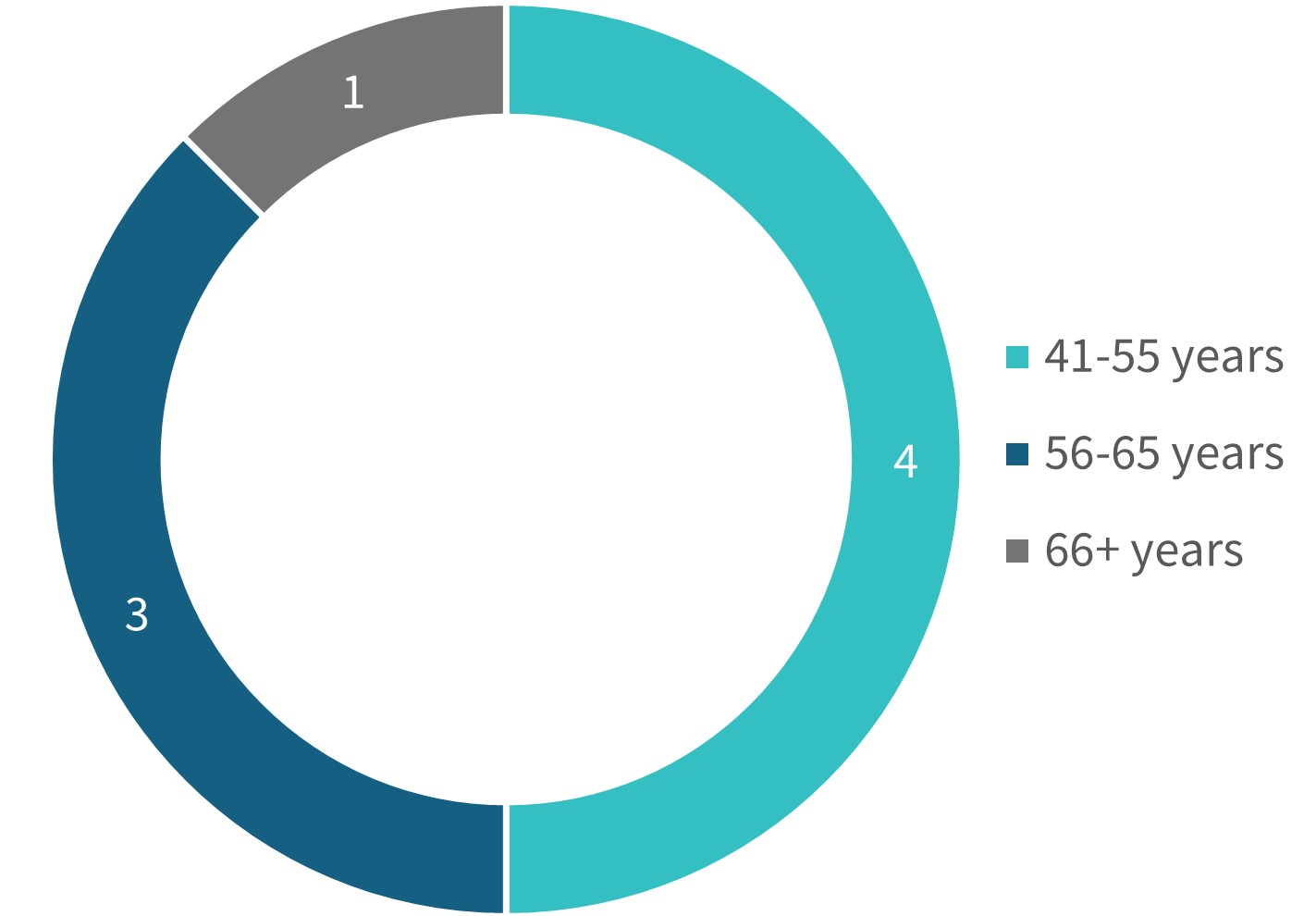

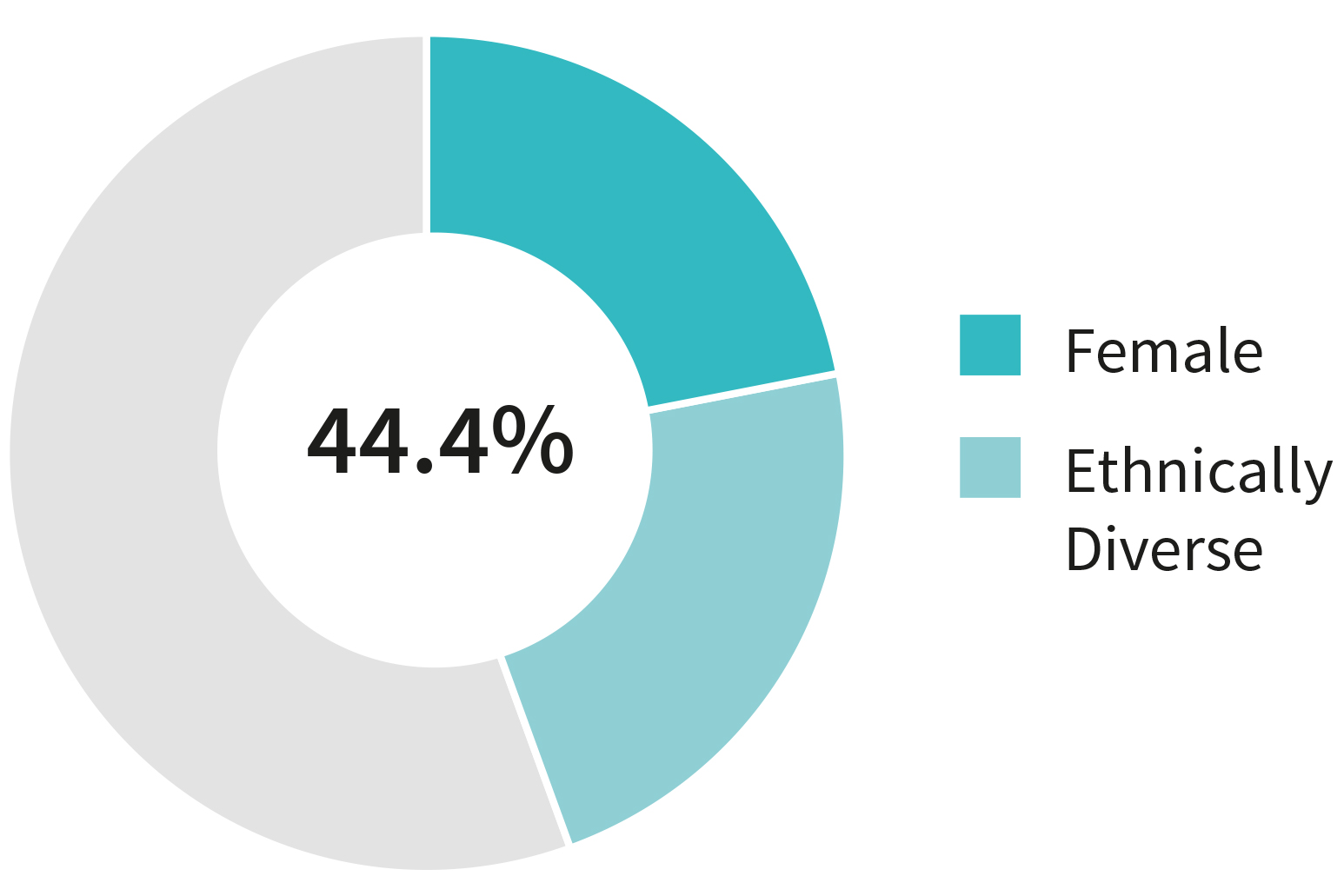

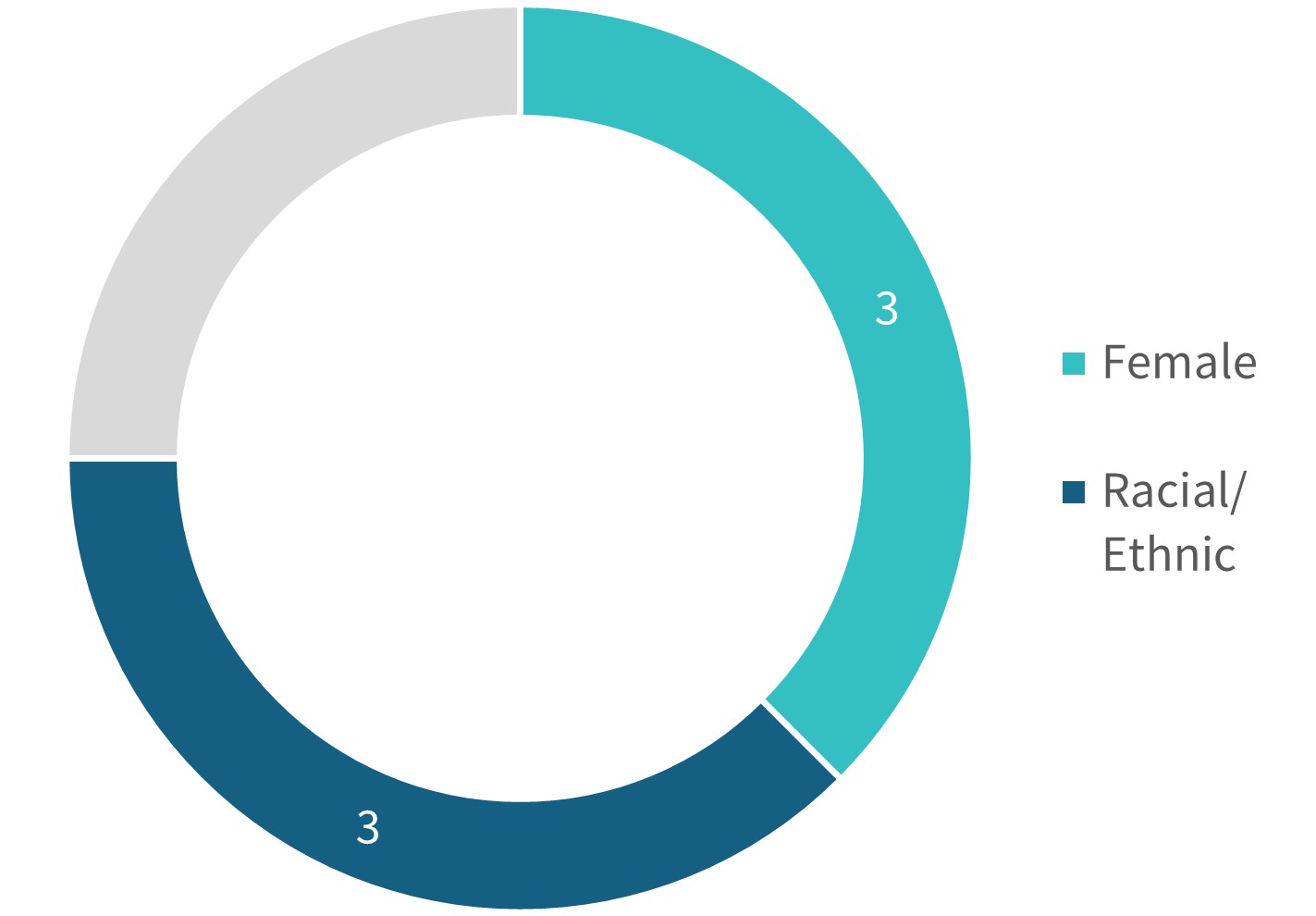

| INDEPENDENCE | TENURE | | AGE | | DIVERSITY |

| | | | | | | | | | |

Independent | | | <4 years | | | <40 years | | | Female | |

| Sustainability Strategy and Reporting | 8/9

| | | 2/9

| | | 1/9

| | | 2/9Our priority sustainability topics are based on an assessment we conducted in 2020 and enable us to concentrate our efforts on the topics most impactful to our Company and stakeholders. This assessment was informed by interviews and surveys with key stakeholders, in addition to a comprehensive review of industry trends, benchmarks and risk factors. We report our progress against our priority sustainability topics and strategy in our annual sustainability report.

|

| | | | | | | | | | |

| Not independent | | 4-6 years | | | 41-49 years | | | Ethnically diverse | |

GHG Emissions -

Reduction | We address the urgent challenge of climate change. In 2022, we announced our goal to reduce our scope 1/9 | | | 4/9

| | | and 2/9 | | | 2/9 greenhouse gas (“GHG”) emissions by 50% by 2025 from a 2019 baseline. We are proud to have achieved this goal as of the end of 2023, two years ahead of schedule, through our data center efficiency and corporate real estate optimization efforts. Moving forward, we hope to develop new and thoughtful plans that push us to reduce our environmental impact even further.

|

| |

| |

| UN Sustainable Development Goals (SDGs) | | | | | | | | | | We are committed to the United Nations (UN) SDGs. We are members of the UN Global Compact and pledge to support the Ten Principles of the UN Global Compact on human rights, anti-corruption, labor and environment. We disclose our progress against the UN SDGs each year in our annual sustainability report. |

| |

| |

| Diversity, Equity, Inclusion and Belonging (DEIB) | | | >6 years | | | 50-60 years | | | | We disclose our employee diversity and pay parity data annually and work to integrate DEIB principles into our business. In 2023, we achieved pay parity for gender (globally) for the ninth year in a row and ethnicity (U.S.) for the seventh year in a row1. We also publicly disclose our EEO-1 data. In 2023, we launched a DEIB Steering Committee comprised of senior leaders to help govern, support and enable our DEIB efforts across the Company. |

| |

| |

| Employee Engagement |  | 3/9

| | | 4/9

| | | |

| |

| |

| Venture Forward | | | | | | | | | | GoDaddy Venture Forward is a research initiative that quantifies the growth and economic impact of more than 20 million microbusinesses. Through Venture Forward, we created the Microbusiness Data Hub, which offers free, downloadable anonymized data on microbusinesses and the entrepreneurs who own them. Venture Forward enables advocates for entrepreneurship to build stronger, more inclusive and equitable communities and economies. |

| |

| |

| Empower by GoDaddy | | | | | | >60 years | | | | We leverage Empower by GoDaddy, our signature global social impact program, to propel entrepreneurs in underserved communities. In 2023, we served nearly 2,900 entrepreneurs in communities across the U.S., Canada, Germany and the U.K. through 250 workshops and more than 1,450 one-on-one mentorship sessions. |

| | | | | |

| 2/9

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SKILLS AND EXPERIENCE

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Public Company Leadership Experience

5/9

| | Technology Experience

7/9

| | Global Experience

6/9

| | CorporateTo read more about our sustainability strategies, practices, programs and disclosures, please visit: godaddy.com/godaddy-for-good/sustainability. For more information on our Nominating and Governance Experience

4/9

| | Public Company Board Experience

7/9Committee’s oversight of such strategies, practices, programs and disclosures, please see the section titled “Sustainability Risk Oversight” onpage 37. |

|

| | Financial / Accounting Experience

5/9

| | Sales & Marketing Experience

4/9

| | Human Capital / Executive Compensation Experience

4/9

| | Risk Management / Compliance / Cybersecurity Experience

5/9

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Key Corporate Governance Practices

Stockholder Engagement

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| 87%

Shares Contacted

| | 47%

Shares Engaged

| | 23%

Shares Met with Directors

| Proxy Summary |

Our Board of Directors

Proposal No. 1 — Election of Directors begins on page 19 of this Proxy Statement. The Board of Directors (the “Board”) has nominated Mark Garrett, Srini Tallapragada and management takeSigal Zarmi to serve as Class II directors and Herald Chen, Brian Sharples and Leah Sweet to serve as Class III directors, each for a long-term, constructive view toward stockholder engagement. We recognizeone-year term that stockholder feedback is critical to driving growth, creating value, and most importantly being responsible stewards of stockholder capital. As a result, our management team regularly engages with our stockholders to understand their perspectives, often with directors joiningexpires at the discussion. We appreciate our stockholders’ willingness to engage with us and to provide their perspectives.

Following our 20212025 annual meeting of stockholders we contacted stockholders representing 87%and until their successors are duly elected and qualified or until their earlier resignation, death or removal.

The Board unanimously recommends that you vote “FOR” each of our shares outstanding and engaged with 47%the nominees named in Proposal No. 1.

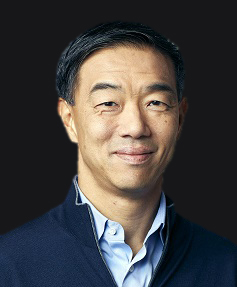

Overview of our shares outstanding. MembersOur Board of our Board, including our Chair, Chuck Robel, and our Compensation and Human Capital Committee Chair, Brian Sharples, led the discussions with stockholders representing 23% of our shares outstanding. Messrs. Robel and Sharples’ active leadership in these meetings reflects our Board’s commitment to engaging with and hearing from our stockholders.Directors

We enhanced our stockholder engagement program, focusing in particular on increased engagement with governance teams at our large institutional investors. We instituted a year-round process to provide our stockholders regular opportunities to share their feedback, input and advice on strategy, governance, compensation, disclosure and any other issues. As a part of this program, we received constructive, valuable feedback from our stockholders and took numerous actions to address their suggestions: | | | | | | | | | | | | | | | | | | | | |

Name and Principal Occupation1 | Age | Independent | Director Since | Board Committees |

| CLASS I – Current Term Expires at 2025 Annual Meeting | | | | |

| Amanpal (Aman) Bhutani Chief Executive Officer, GoDaddy | 48 |

| 2019 | |

| Caroline Donahue Former Executive Vice President and Chief Marketing and Sales Officer, Intuit | 63 | | 2018 | |

| CLASS II – Current Term Expires at 2024 Annual Meeting | | | | |

| Mark Garrett Former Executive Vice President and Chief Financial Officer, Adobe | 66 | | 2018 | |

| Srinivas (Srini) Tallapragada President and Chief Engineering Officer, Salesforce | 54 | | 2023 | |

| Sigal Zarmi Senior Advisor, Boston Consulting Group | 60 | | 2023 | |

| CLASS III – Current Term Expires at 2024 Annual Meeting | | | | |

| Herald Chen Former President and Chief Financial Officer, AppLovin | 54 | | 2014 | |

| Brian Sharples - Chair of the Board Co-founder and Former Chairman and Chief Executive Officer, HomeAway | 63 | | 2016 | |

| Leah Sweet Former Senior Vice President, PayPal | 55 | | 2020 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

|  (the “Audit Committee”) | | | | | | |

| What We Heard | | How We Responded | |

| Executive Compensation Practices | | Executive Compensation Practices | |

| •Refresh compensation disclosure and analysis to enhance disclosures including incorporating graphics and supplemental disclosures

| | •Enhanced proxy disclosures, including additional rationale and context around changes made, added a proxy summary and incorporated user-friendly visual presentations

| |

| •Enhance disclosure to provide clarity that there is a cap on short-term incentives

| | •Enhanced disclosure to clarify the maximum payout under the corporate and individual components of the STIP (page 46)

| |

| •Add disclosure related to individual achievements for the individual portion of the short-term incentive plan

| | •Provided additional explanation of individual performance goals and achievements under the short-term incentive program (pages 46 - 49)

| |

| •Provide forward looking qualitative metrics for short-term incentive scorecard

| | •Disclosed CEO qualitative scorecard metrics for 2022

| |

| •Adopt a more rigorous anti-pledging policy

| | •Enhanced our anti-pledging policy to prohibit pledging of company shares by directors and employees under any circumstances

| |

| •Align CEO compensation program design with the program design of other named executive officers

| | •Approved largely performance-based CEO compensation package in 2021, similar to those in place for other named executive officers

| |

| | | | | | | | |

| Corporate Governance Practices | | Corporate Governance Practices | |

| •Declassify the Board and directors to serve annual terms

| | •Board approved the management proposal on this year’s proxy ballot to declassify the Board (page 69)

| |

| •Remove the supermajority requirement to amend the Company’s Amended and Restated Certificate of Incorporation (“Charter”) and Bylaws

| | •Board approved the management proposal on this year’s proxy ballot to remove the supermajority requirements (page 71)

| |

| •Rotate the Board’s Committee leadership position

| | •Appointed Mark Garrett as the new Chair of our Audit Committee and Leah Sweet as the new Chair of our Governance Committee

| |

| •Disclose formalized Board-level oversight over environmental, social and governance (“ESG”) matters to ensure appropriate focus on such initiatives

| | •Updated the Nominating and Governance Committee Charter to formalize responsibility for oversight of ESG developments and disclosures

(the “Governance Committee”) | | |

| •Institute dedicated Board-level oversight of human capital management

| | •Updated the Compensation and Human Capital Committee Charter to include responsibility for oversight of our human capital management practices

(the “Compensation Committee”) | |

| •Adopt majority vote standard for director elections | Chair | | •Amended our Bylaws to adopt a majority voting standard in uncontested director elections

|

| •Formalize Company guidelines on directors’ other public company board service

| | •Revised Corporate Governance Guidelines to include a policy on director service on other public company boards

| |

1Ryan Roslansky and Lee Wittlinger retired from the Board effective January 25, 2023, and Chuck Robel retired from the Board effective as of the 2023 Annual Meeting on June 7, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Executive Compensation Highlights

The Compensation and Human Capital Committee, which is responsible for the Company’s executive compensation policies and plans is committed to designing a competitive, fair and equitable compensation program that promotes pay for performance, delivers stockholder value and is responsive to stockholder feedback.Director Identification

2019 Stockholder EngagementSkills and 2020 Compensation Program Design

In 2019, the Compensation Committee thoughtfully evaluated the executive compensation program structure, taking into account valuable feedback received from stockholders through our yearly engagement process and considering the ongoing evolution of our business. At that time, we approved several changes to the performance-based compensation program, which took effect for our named executive officers (“NEOs”) other than our CEO beginning in 2020. These improvements included:Experience

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| Our Board has identified the following skills and experiences as important in ensuring that our directors collectively possess the necessary core skills and specific areas of expertise to provide effective oversight of our Company and our long-term strategic growth. |

| |

| Removed stock options from the mix of awards granted under the long-term incentive plan (“LTIP”) | Technology Experience 6/8 | | Sales & Marketing Experience 4/8 |

| Increased the percentage of the LTIP that is performance-based to 50% of the overall LTIP |

| Eliminated overlapping metrics between the short-term incentive compensation program (“STIP”) and the LTIP |

| | | |

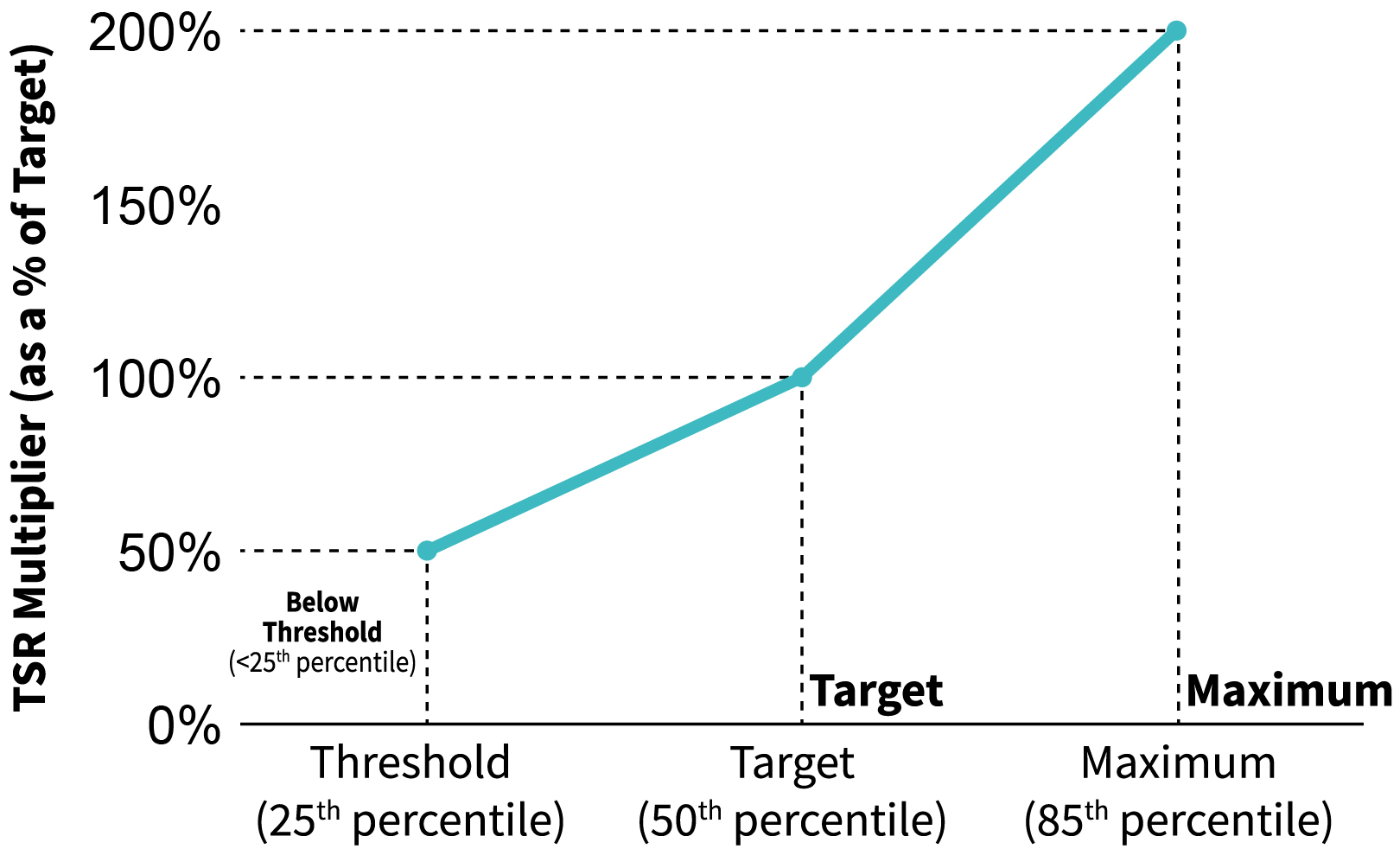

| Incorporated a relative total stockholder return (“rTSR”) performance metric under the performance share unit awards to further align the interests of our executives and our stockholdersStrategic Planning Experience 5/8

| | Human Capital / Executive Compensation Experience 3/8 |

| Amended our Equity Ownership Guidelines to adopt stock ownership guidelines for executive officers |

| | | |

| Global Experience 7/8 | | |

| | |

| | | | |

| | Public Company Leadership Experience 7/8 | | Public Company Board Experience 7/8 |

| |

| | | |

| Financial / Accounting Experience 4/8 | | Risk Management / Compliance / Cybersecurity Experience 6/8 |

| |

| | | |

| Corporate Governance Experience 4/8 | | |

| |

These changes went into effect for our CEO in 2021,

the first year he was eligible for the new program following his 2019 new hire package.

2021 Say-on-Pay Vote and Stockholder Engagement

Despite the implementation of these holistic changes, we received a disappointing say-on-pay vote in 2021. During our 2021 engagement roadshow we sought to better understand our stockholders’ perspectives. Our Compensation Committee Chair joined several of these conversations to hear from stockholders directly. Stockholders told us they are broadly supportive of the Company’s overall compensation program philosophy, design and metrics. Therefore, the Compensation Committee was comfortable maintaining the 2020 compensation program features for the 2021 compensation plans.

| | | | | | | | | | | | | | |

| | | | |

For more information about our Board of Directors, including their biographical information, please see the sections titled “Nominees for Director” and “Continuing Directors” beginning on page 20. |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Proxy

Summary | | Board and

Governance Matters | | Executive

Compensation | | Audit

Matters | | Other Management

Proposals | | Other

Information |

| | | | | | | | | | |

We also identified key drivers for votes against the executive compensation proposal by investors who were otherwise generally supportive of the program. Specifically, these investors were looking for GoDaddy to enhance its disclosure to provide information that is helpful in their respective analyses of the compensation program. Based on these learnings, we enhanced our disclosure by:

| | | | | |

| |

| Clarifying that the maximum payouts under STIP are capped |

| Adding disclosure related to the achievement of individual performance goals under the STIP |

| Expanding our anti-pledging policy |

| Revamping our proxy design with user-friendly visual charts and graphs |

| Outlining the evolution of our compensation programs, including the changes implemented in 2020 in response to stockholder feedback |

| Providing additional compensation discussion and analysis disclosures, adding a proxy summary and incorporating visual presentations |

We are hopeful that, with these enhancements, our stockholders will have a clearer understanding of our executive compensation program and philosophies, including the ways in which we revamped our programs in direct response to stockholder feedback.

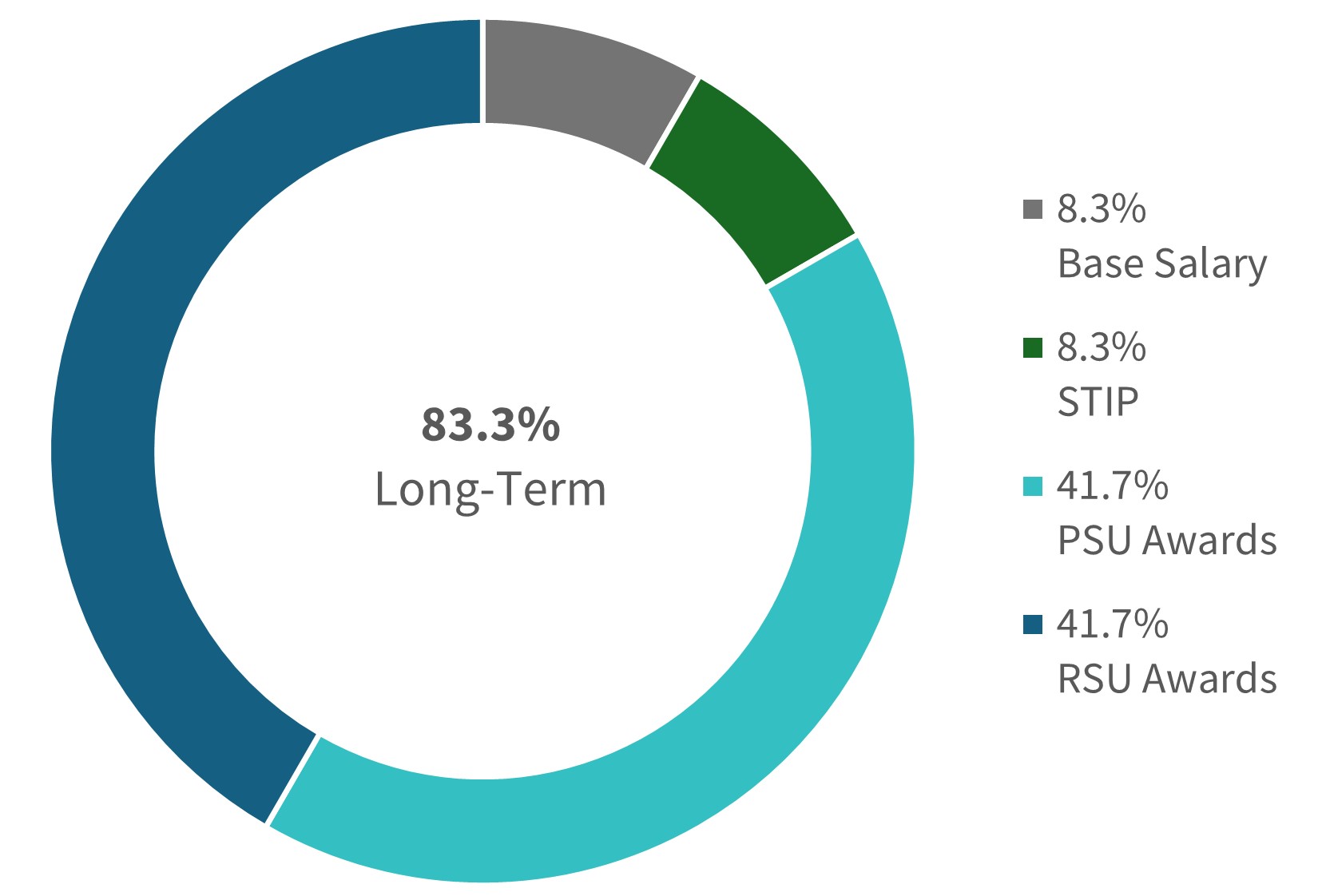

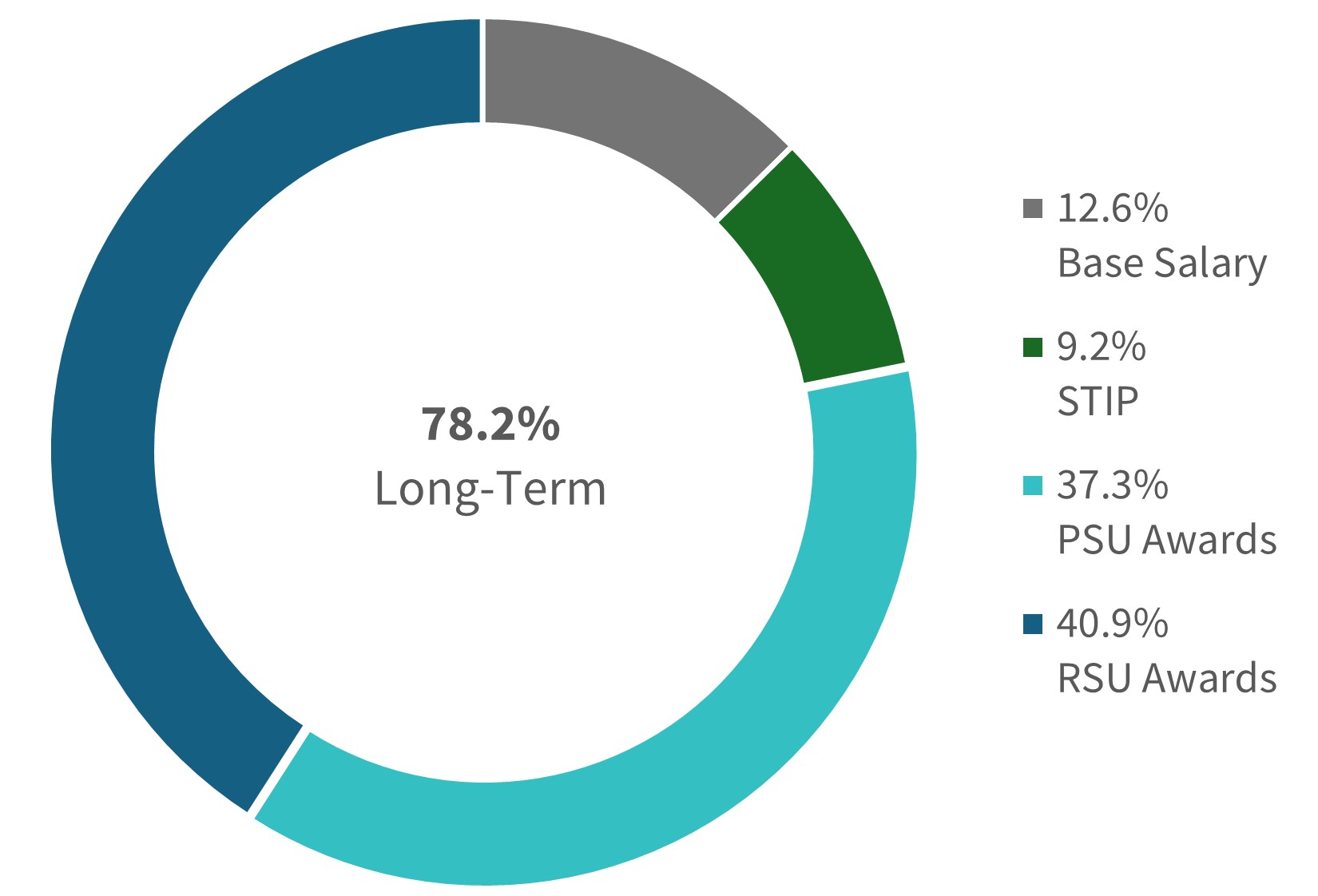

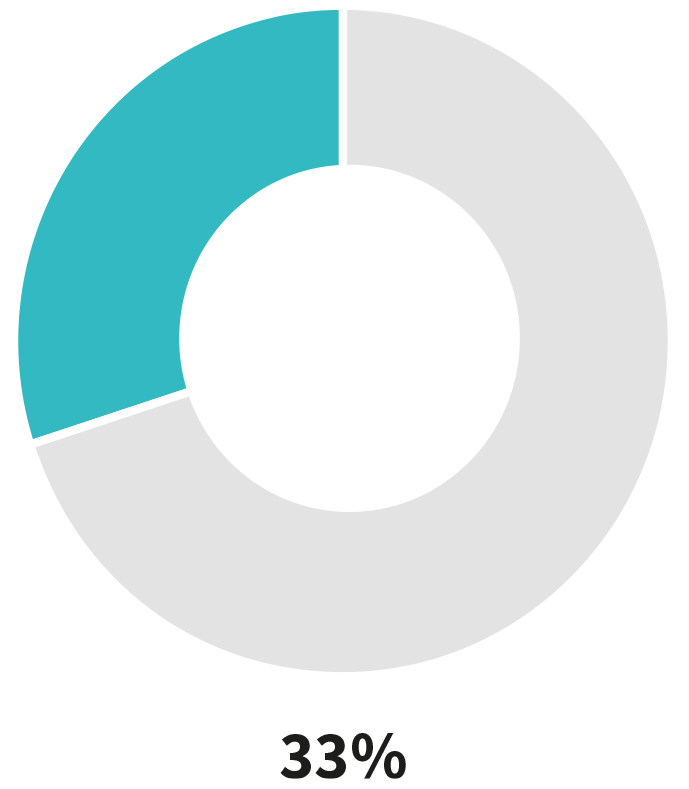

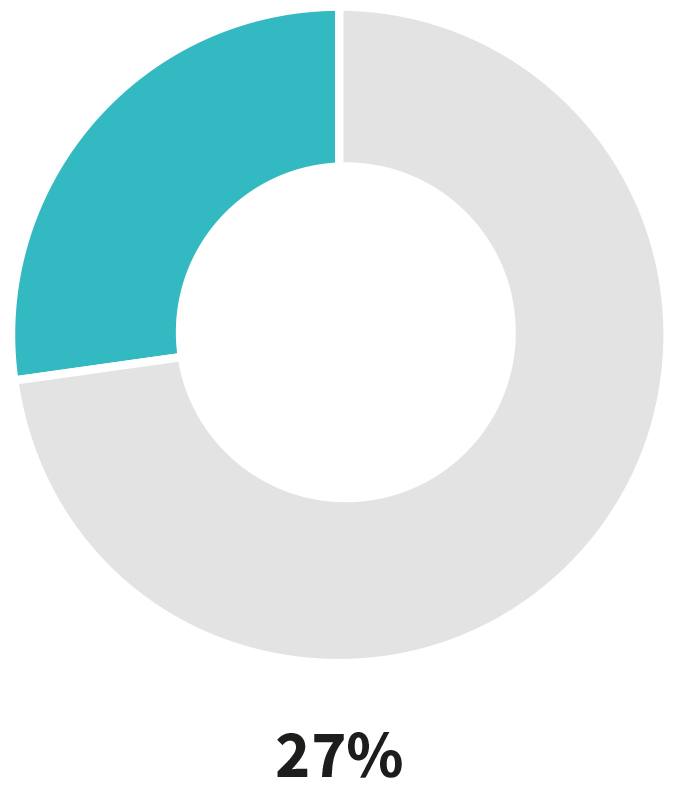

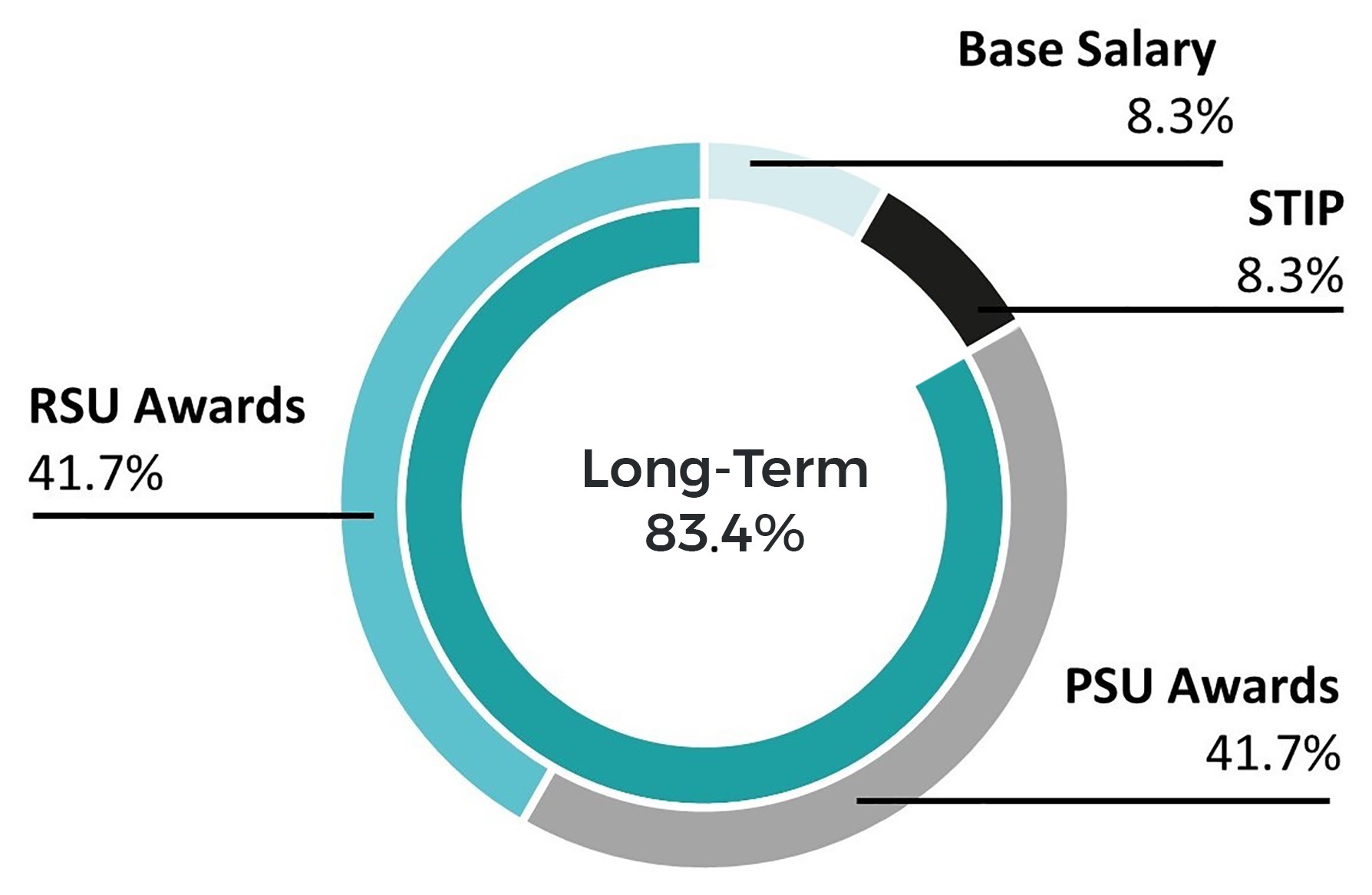

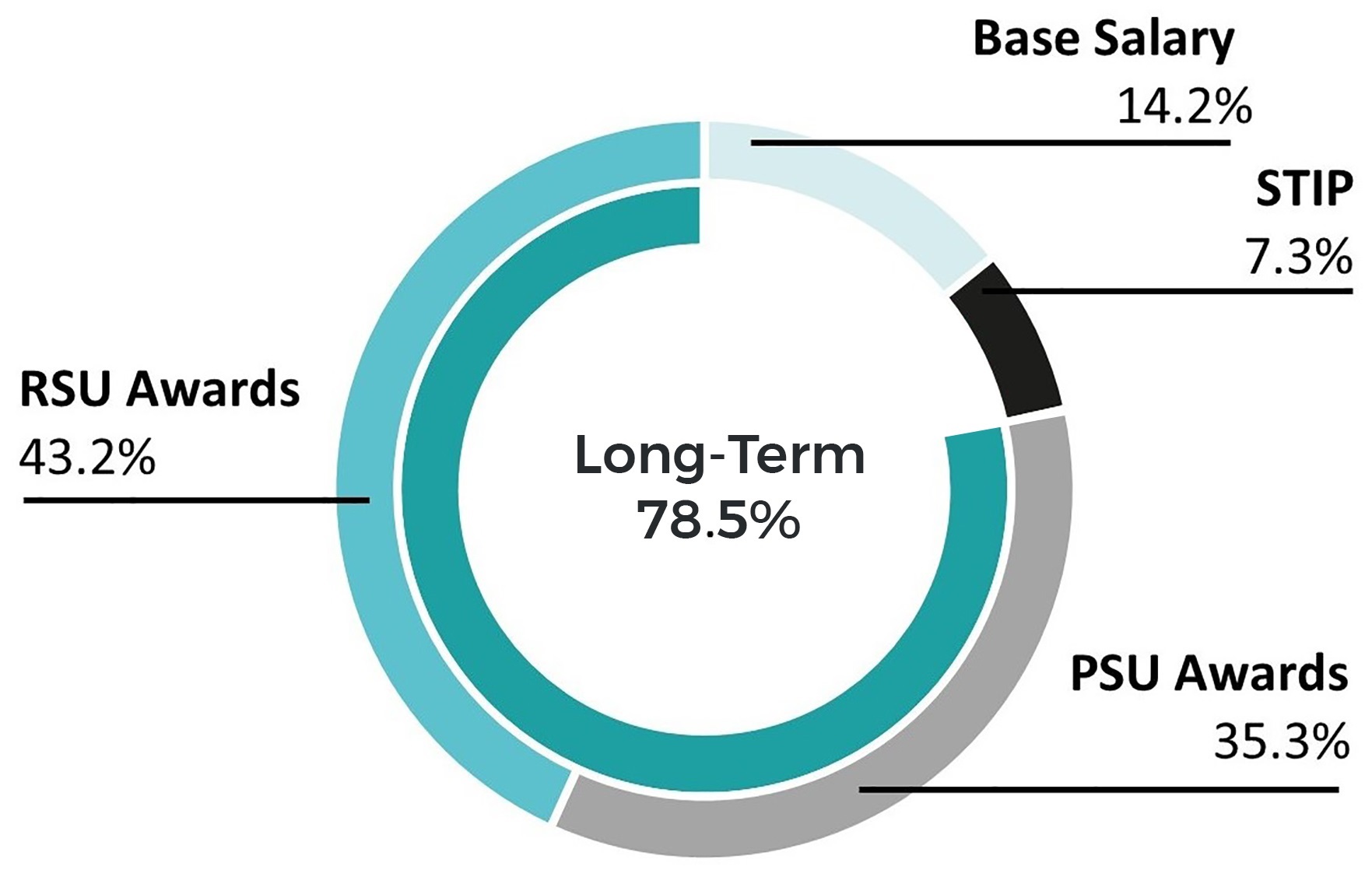

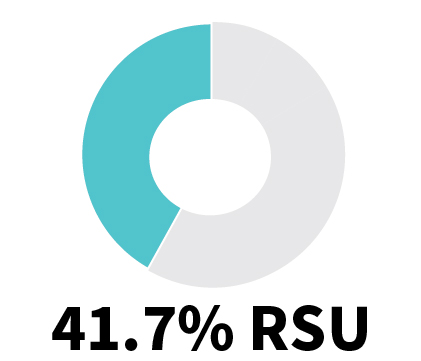

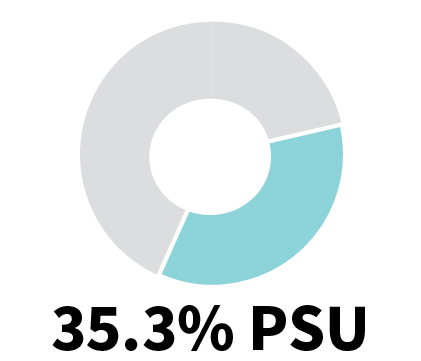

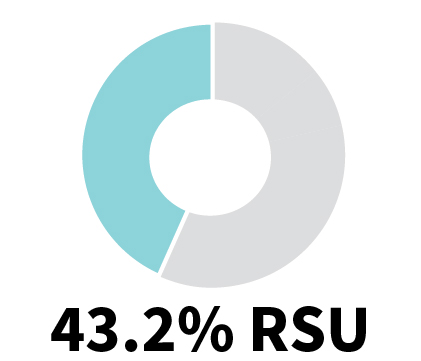

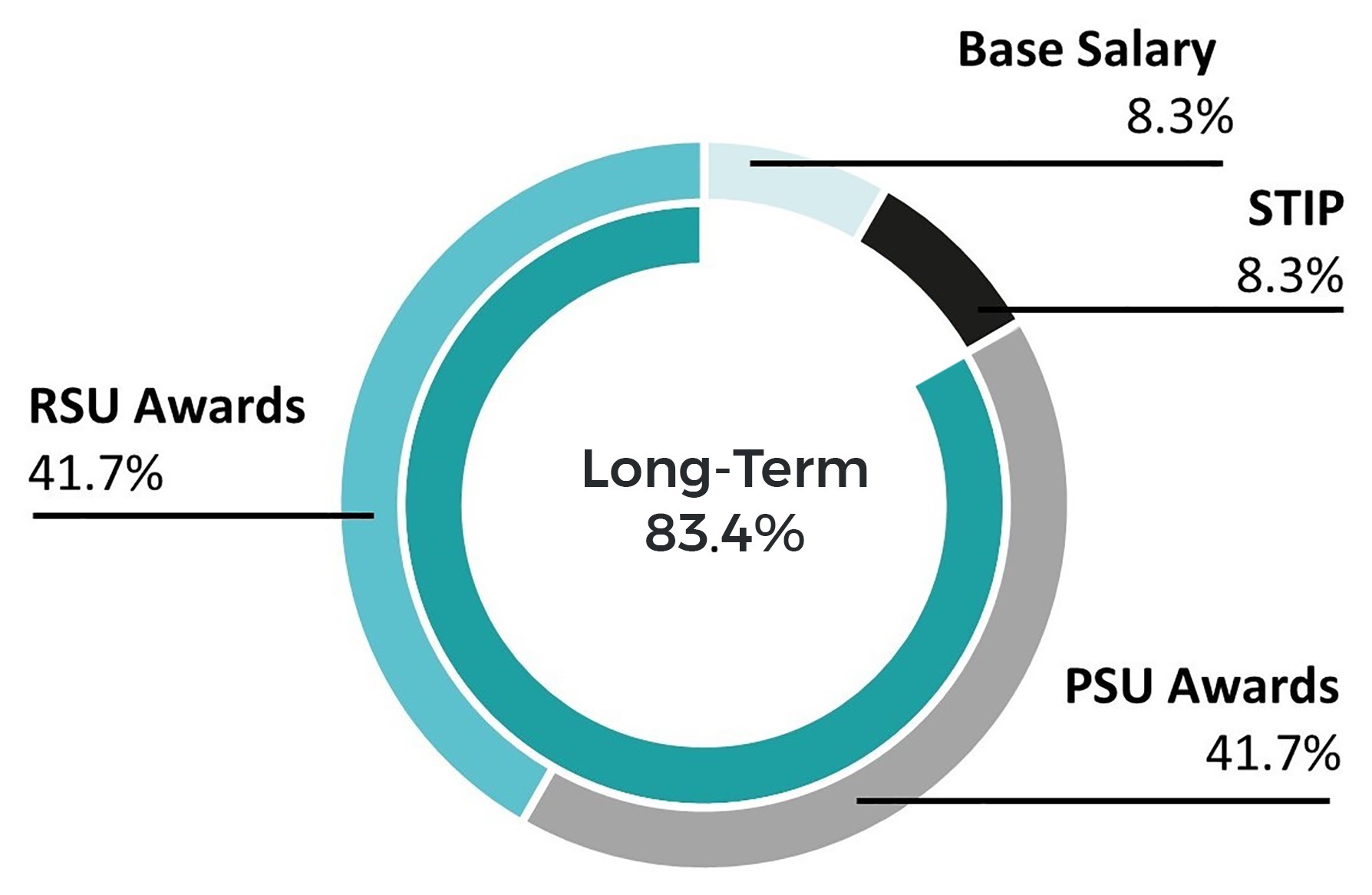

2021 Compensation Program Summary Target Compensation Pay Mix

| | | | | | | | |

Component | 2021 Compensation Plan | Rationale |

FIXED |

Base Salary | •Targeted at competitive levels and based on past experience and expected future contributions

| •Establishes competitive pay that properly incentivizes executive officers for day-to-day responsibilities

|

VARIABLE |

Short-Term Incentive Compensation | •80% - Corporate Performance Goals

•50% Bookings

•50% Unlevered Free Cash Flow

•20% - Individual Performance Goals

| •Provides the appropriate incentives for our executive officers to work collaboratively as a team to achieve important financial, business and strategic goals in our operating plan and to reward individual contributions

|

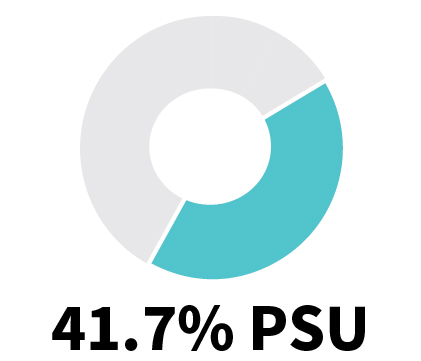

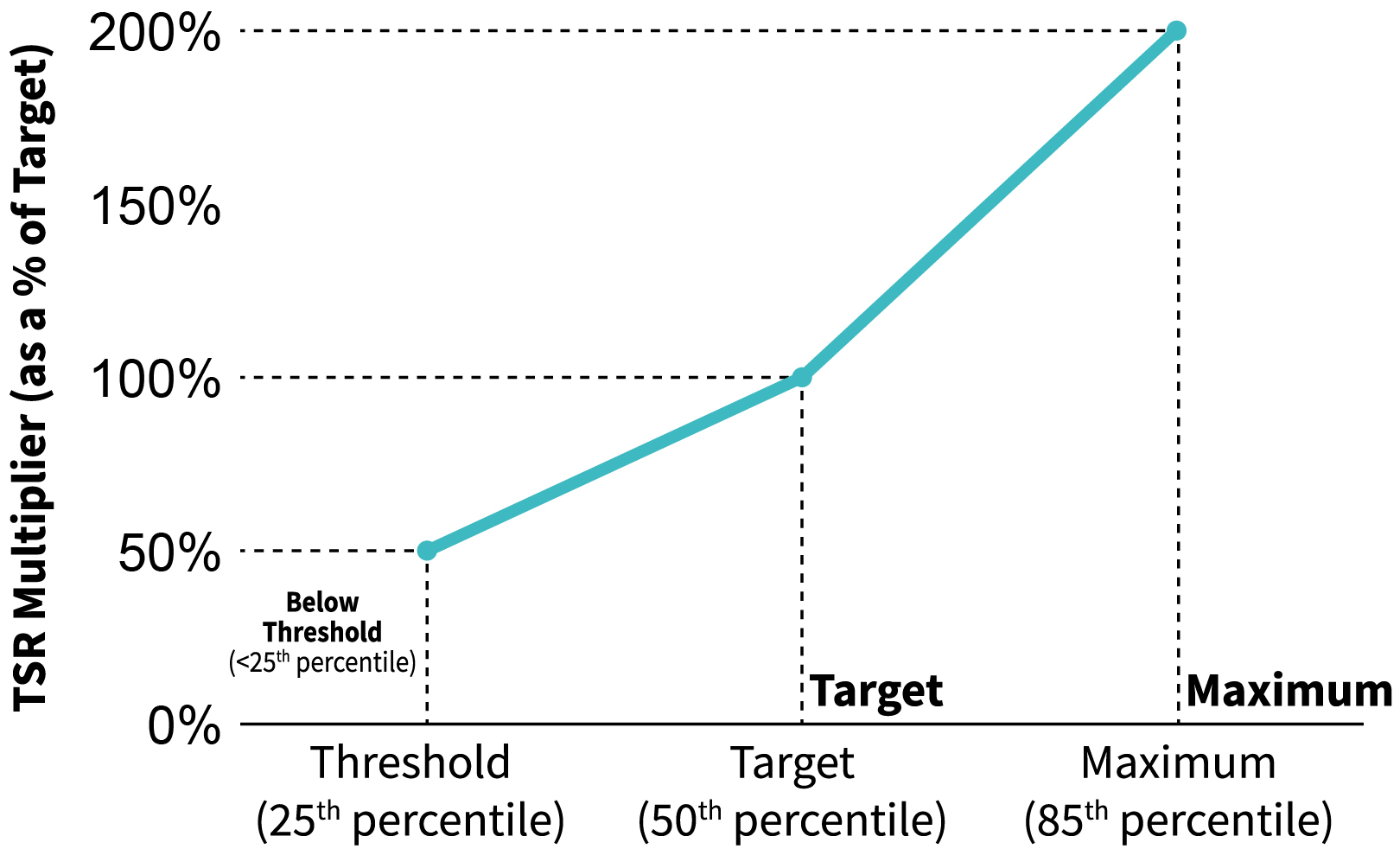

Long-Term Incentive Compensation | •50% - Performance-Based Restricted Stock Units (“PSUs”)

•100% rTSR metric measured against the Nasdaq Internet Index

•Cliff vests after 3-year performance period

•50% - Time-Based Restricted Stock Units (“RSUs”)

•Vest over a 4-year period with 25% vesting after the first year and equal quarterly vesting for the next 3 years

| •Strengthens the alignment between the interests of our executive officers and our stockholders by tying vesting of awards to achievement of a relative TSR measure against the Nasdaq Internet Index, which incentivizes our executives to drive long-term stockholder value

•Our use of both time- and performance-based equity awards also promotes executive officer retention by linking vesting to continued employment

|

| | | | | | | | |

Target Compensation and Pay Mix |

CEO | | ALL OTHER NEOs (average) |

| | |

| | |

| | | | | | | | | | | | | | |

| | | 20222024 Proxy Statement | 13 |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Sustainability Highlights

Our mission is to empower entrepreneurs everywhere and make opportunity more inclusive for all. We seek to understand the most important issues facing our stakeholders, our society, our business, and our industry — and to take proactive steps that are designed to help ensure that our sustainability practices represent what we believe are unmistakably positive forces for those we serve and for the world at large. We strive to combine a greater transparency with a relentless focus on how we can be better every day.

Proposed Governance Enhancements

In direct response to stockholder feedback, the Board approved four management proposals for this year’s proxy ballot to:

| | | | | | | | | | | | | | | | | | | | |

Declassify the Board | | Remove Supermajority Vote Requirement | | Eliminate Certain Business Combinations and Restrictions | | Eliminate Inoperative Charter Provisions |

Provides stockholders the ability to annually elect directors. | | Provides stockholders the ability to approve amendments to our Charter and Bylaws or remove directors with majority support. | | Subjects the Company to the business combination restrictions of Section 203 of the Delaware General Corporation Law. | | Streamlines the Charter and implements certain miscellaneous amendments, including to provisions related to the Company’s former sponsors. |

| | | | | | |

For a more detailed description of these proposed governance enhancements, see Proposals 5, 6, 7 and 8 in this Proxy Statement.

Governance Practices and Highlights

Our corporate governance framework lays the foundation for effective oversight and management accountability and enables GoDaddy to remain competitive in the dynamic environment in which we operate.

We are committed to good corporate governance and ensuring our practices are aligned with our strategic priorities. The following list highlights our corporate governance practices:

| | | | | | | | | | | |

| | | |

|  Independent Board Chair Independent Board Chair 100% independent committee members 100% independent committee members Declassified Board (fully phased in by 2025) Declassified Board (fully phased in by 2025) Majority vote standard for director elections with director resignation policy Majority vote standard for director elections with director resignation policy Responsive and growing stockholder engagement program No supermajority voting requirement Robust Board and director self-evaluation process Robust Board and director self-evaluation process Board guidelines related to service on other public company boards Board guidelines related to service on other public company boards Disclosure of director skills matrix and diversity on individual basis Disclosure of director skills matrix and diversity on individual basis Board diversity (over 40% female and/or minority directors) Responsive stockholder engagement program | |  Recent Board committee refreshment Thoughtful succession planning process Board committee oversight of sustainability matters Succession planning process  Periodic review of committee charters and governance policies Periodic review of committee charters and governance policies Regular meetings of independent Regular meetings of independent Directorsdirectors without management Annual Sustainability and Diversity and Parity Reports Majority of directors are diverse Formalized Governance Committee oversight of sustainability matters Formalized Governance Committee oversight of sustainability matters Formalized Compensation Committee oversight of human capital management Formalized Compensation Committee oversight of human capital management Formalized Audit Committee oversight of cybersecurity Formalized Audit Committee oversight of cybersecurity |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

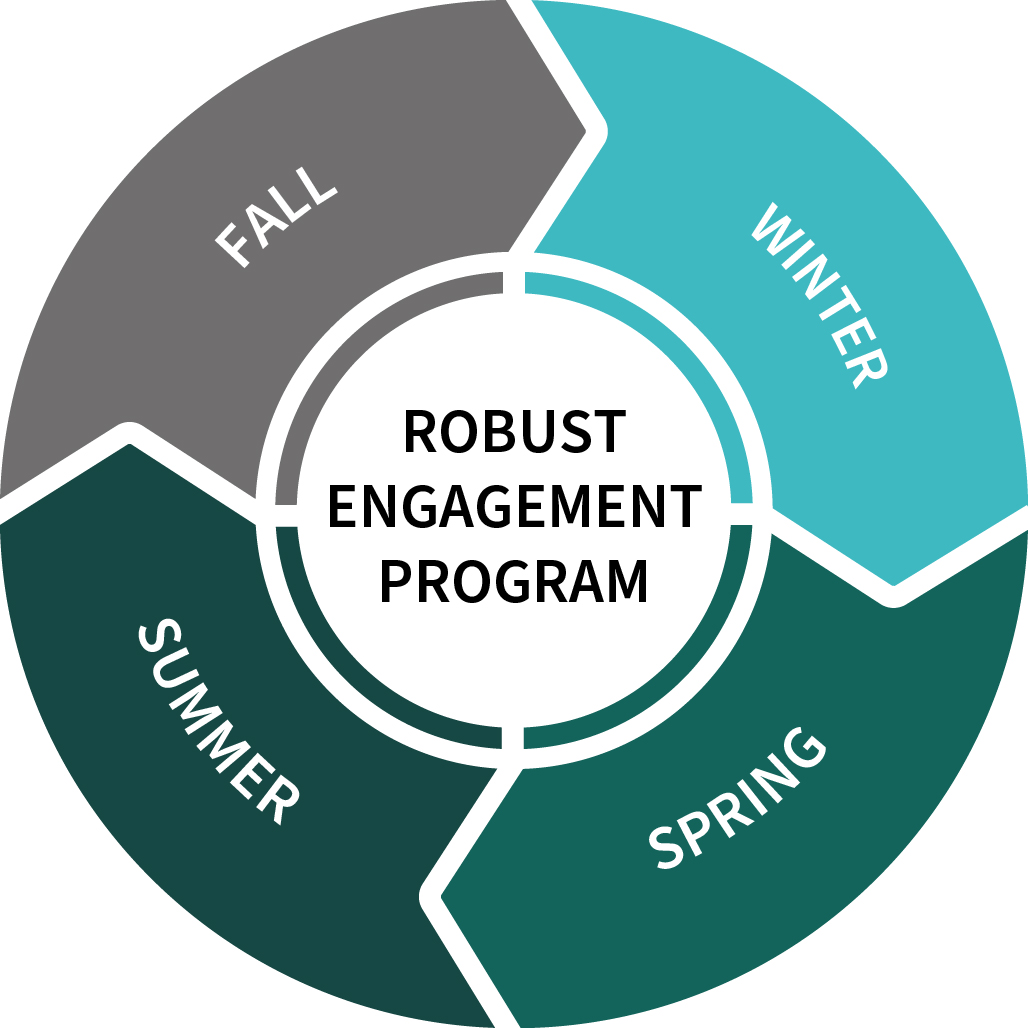

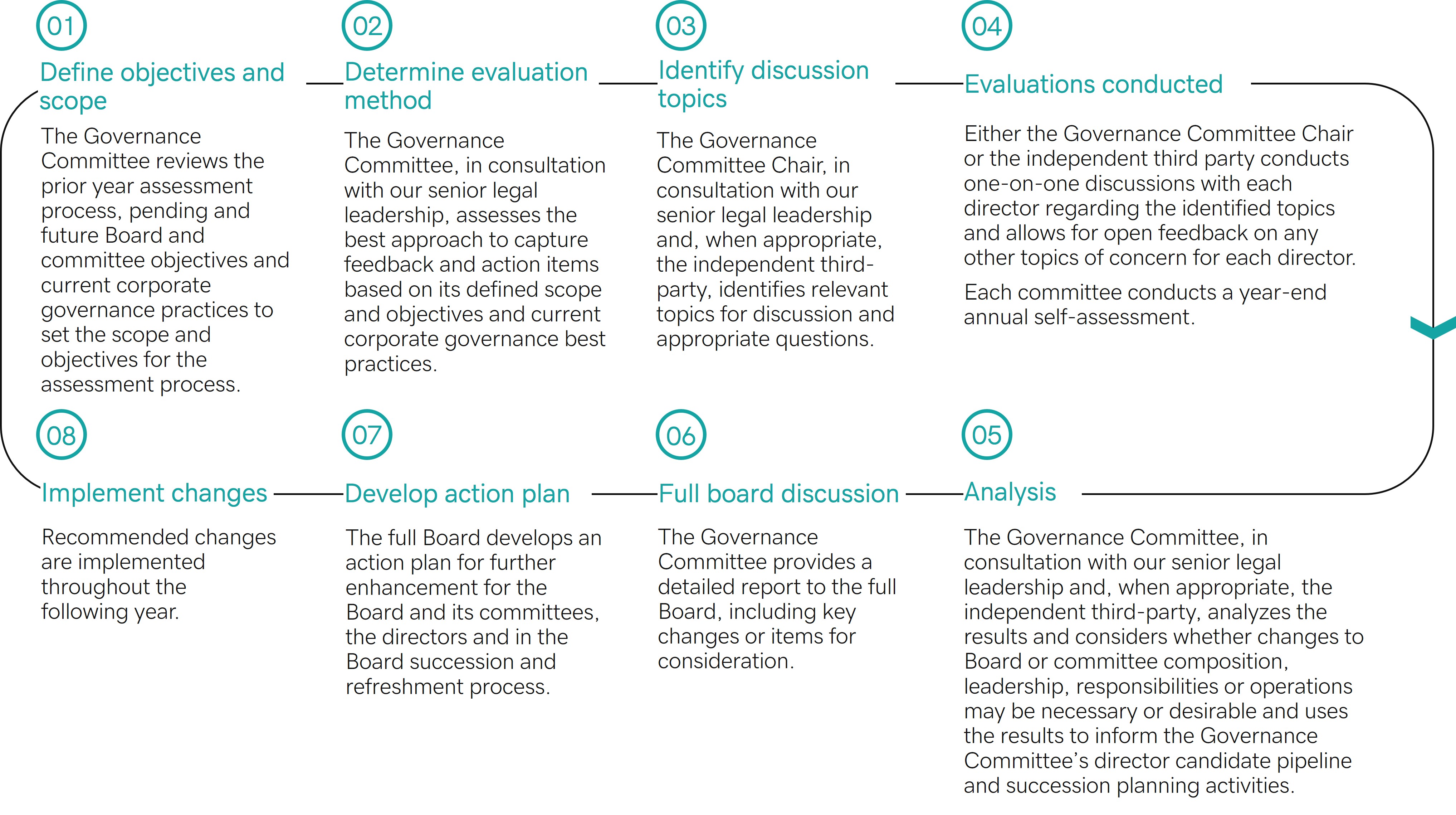

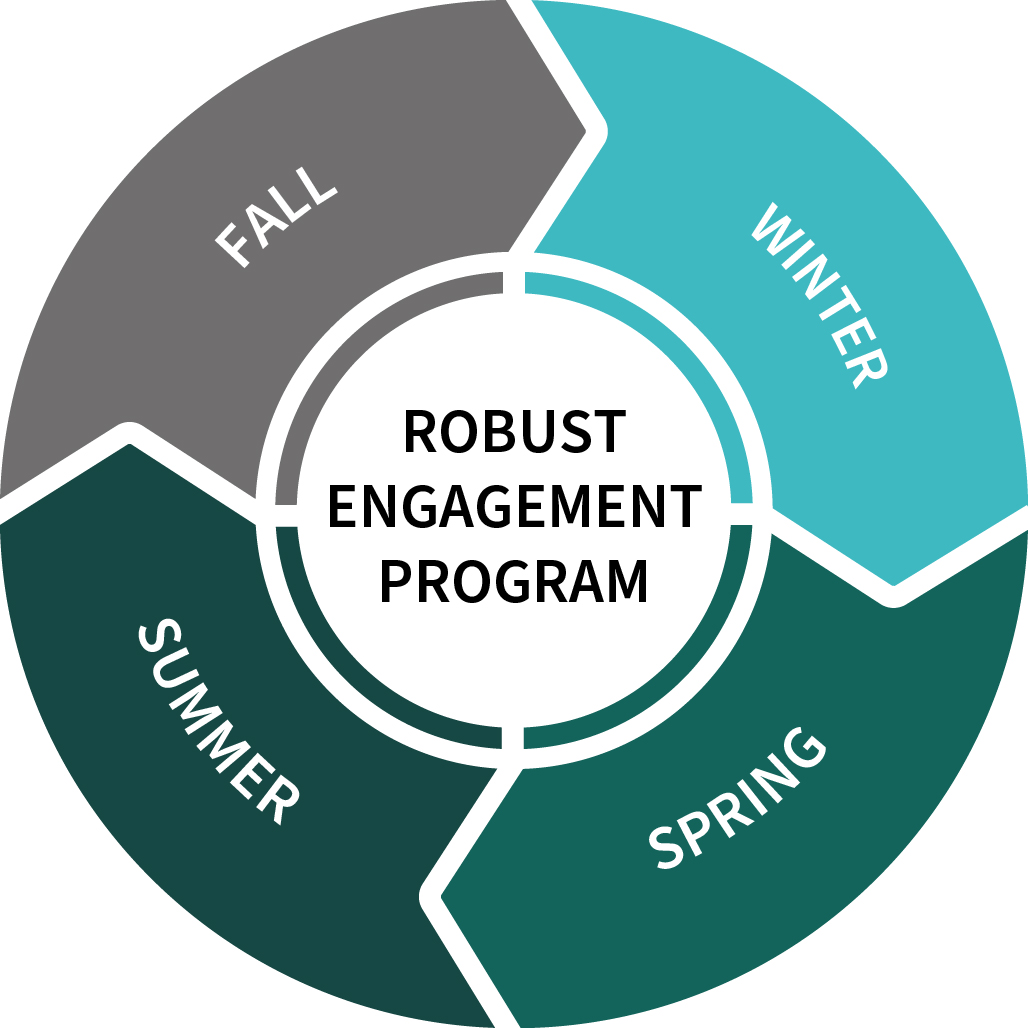

EnvironmentalStockholder Engagement

As part of good governance, we conduct a year-round engagement process that provides our stockholders the opportunity to share their feedback, input and Social Practices and Highlightsadvice.

We understand that prioritiesOffered Meetings

63%

of our shares outstanding1

Engaged in Discussions

36%

of our shares outstanding1

Engaged with Director

32%

of our shares outstanding1

1Based on paper mean nothing unless they translate into real-life action. With thatownership as of December 31, 2023.

ENGAGEMENT TOPICS DISCUSSED AND RESPONSIVE ACTIONS TAKEN

In 2023, we continued our annual stockholder engagement process, meeting with stockholders representing approximately 36% of our shares outstanding. As a part of our regular stockholder engagement in mind,2023, we aim everyday to step up the way we bring our sustainability efforts to life. Here are some recent highlights:discussed a range of topics, including:

| | | | | | | | | | | | | | |

| | | | |

Governance and Board Board Leadership Board Composition Director Refreshment & Evaluation Board and Committee Risk Oversight Governance Practices | | Executive Compensation Executive Compensation Program (Say-on-Pay received 96% approval rate at our 2023 Annual Meeting) Compensation Plan Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Environmental and Social Diversity, Equity, Inclusion & Belonging Human Capital Management Environmental Sustainability Data Privacy and Cybersecurity |

| | | | |

Informed by stockholder feedback, we made several changes to our proxy disclosure, executive compensation program and environmental, social and governance (“ESG”) practices in recent years. These changes include:

| | | | | | | | | | | | | | |

| Governance | | In 2021, we continuedProxy Disclosure |

•Initiated declassification of the Board with annual elections (fully phased in by 2025) •Formalized Board-level oversight of ESG matters, including human capital management | | •Expanded disclosures related to take actionour Board skills, director onboarding and continuing director education •Expanded disclosures related to annual highlights of each committee •Enhanced disclosures regarding Board and committee self-assessment processes •Enhanced disclosures related to the Board’s oversight of cybersecurity |

| | | | |

| Executive Compensation | | Environmental and Social |

•Removed evergreen provisions beginning in 2023 via an amendment to our 2015 Equity Incentive Plan and 2015 Employee Stock Purchase Plan •Added two additional metrics, revenue and NEBITDA, to our short-term incentive plan to further align executive compensation with the Company’s business strategy (see the section “Performance Metrics” in the Compensation Discussion and Analysis section of this Proxy Statement) | | •Committed to reducing our priorities with stakeholder expectations, market trends, business risksscope 1 and opportunities: | | 2 emissions by 50% by 2025 from a 2019 baseline, which we achieved in 2023 Published•Joined the UN Global Compact to further drive commitment to sustainability

•Added diversity and pay parity data, formerly found in a stand-alone report, into ourinaugural annual Sustainability Report which references the Global Reporting Initiative Standards and aligns with the Sustainability Accounting Standards Board’s standards | | | Presented the results of•Continued our first materiality assessment of sustainability topics that intersect withtransparency on DEIB efforts by publishing our business and identified current “priorities” and “important issues”EEO-1 data

| | | Named one of 2021 Forbes Best Employers for Women

| |

| | | | |

| | |

| | |

|

For more information about our year-round engagement program please see the section “Stockholder Engagement Approach and Philosophy” onpage 38. |

| | | | | | Revised our approach to the management and oversight of sustainability issues by assigning oversight of developments and disclosures regarding corporate governance practices and ESG matters to our Nominating and Governance Committee

| |

| | | | | | |

| | | | Advanced our efforts to build an environmentally sustainable future by conducting our first greenhouse gas (GHG) inventory and committed to setting reduction targets

| | | |

| | | | | | |

| | | | | | |

| | | Deepened Board oversight of our commitment to our talent management and employee engagement by assigning the Compensation and Human Capital Committee with a new role in assisting the Board with human capital management oversight

| | | | | Achieved 100% Human Rights Campaign / Corporate Equality Index score for the fourth year in a row

| |

|

| | | | | | |

| | | | | | | |

| | | | | Published the results of our annual pay parity and diversity report for the seventh year, demonstrating that GoDaddy once again achieved equitable pay across genders and ethnicities

| |

| | | | | |

| | | | | |

| | | | | | | |

| | | | | | | | | | | | | | |

| | | 20222024 Proxy Statement | 15 |

| | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proxy

SummaryAbout GoDaddy | | | Proxy Summary | | | Board and

Governance Matters | | | Executive Compensation | | Executive

Compensation | Audit Matters | | | Audit

Matters | Other Management

Proposals | | | Other

Information |

| | | | | | | | | | |

Executive Compensation

Proposal No. 2 — Advisory Vote on the Compensation of Our Named Executive Officers begins on page 44 of this Proxy Statement. We are providing stockholders the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our named executive officers (“NEOs”).

The Board unanimously recommends that you vote “FOR” the approval of the compensation of our NEOs.

Compensation Overview

The Compensation Committee, which is responsible for the Company’s executive compensation policies and plans, is committed to designing a compensation program that promotes pay for performance, is competitive, fair and equitable, delivers stockholder valueand is responsive to stockholder feedback.

| | | | | | | | | | | | |

| | | | |

| WHAT WE DO | | | WHAT WE DON’T DO | |

Annual “Say-on-Pay” vote Annual “Say-on-Pay” vote Cap on maximum payouts for each NEO under our short-term incentive plan Cap on maximum payouts for each NEO under our short-term incentive plan Independent compensation consultant engaged by the Compensation Committee Independent compensation consultant engaged by the Compensation Committee Robust stock ownership guidelines for executive officers and non-employee directors Robust stock ownership guidelines for executive officers and non-employee directors Clawback policies on incentive compensation Clawback policies on incentive compensation Ongoing engagement with our stockholders regarding our compensation practices Ongoing engagement with our stockholders regarding our compensation practices Annual compensation review and risk assessment Annual compensation review and risk assessment | |  No hedging of shares by officers or directors under any circumstances No hedging of shares by officers or directors under any circumstances No pledging of shares by officers, directors or employees No pledging of shares by officers, directors or employees No tax gross-ups to cover excise taxes No tax gross-ups to cover excise taxes No resetting of performance targets No resetting of performance targets No “single trigger” change in control payments No “single trigger” change in control payments No excessive perquisites No excessive perquisites No evergreen provisions in equity plans No evergreen provisions in equity plans |

| | | | |

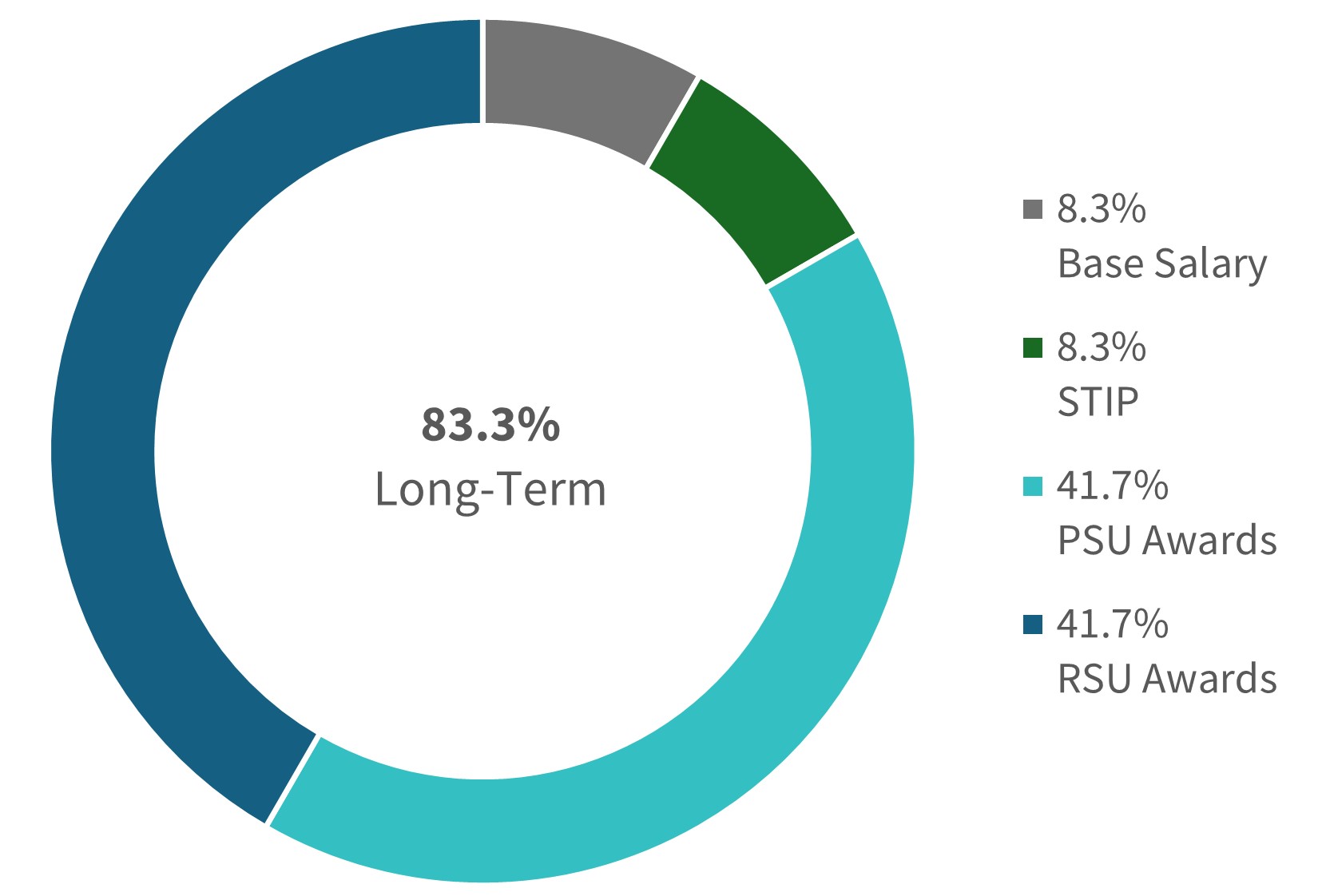

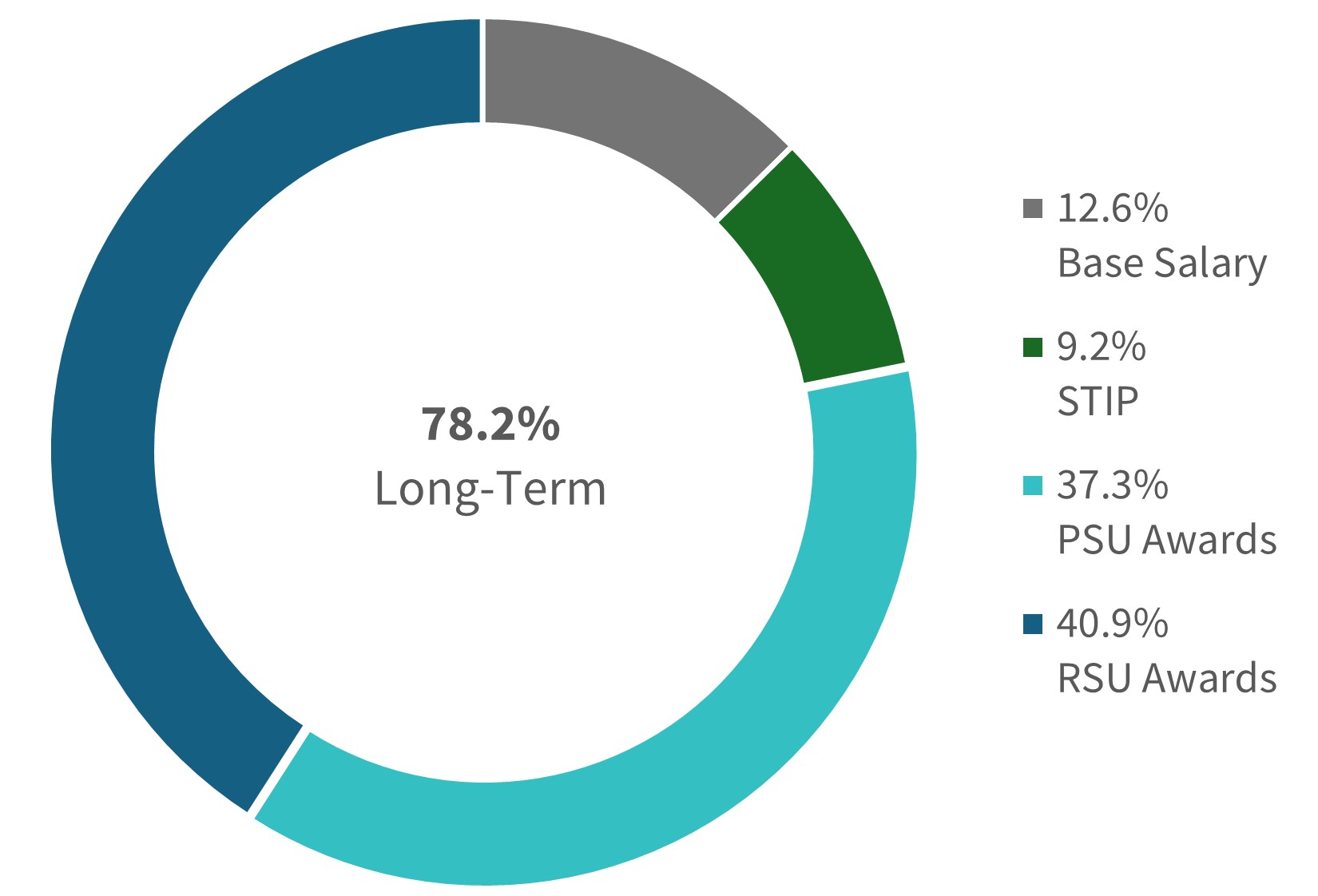

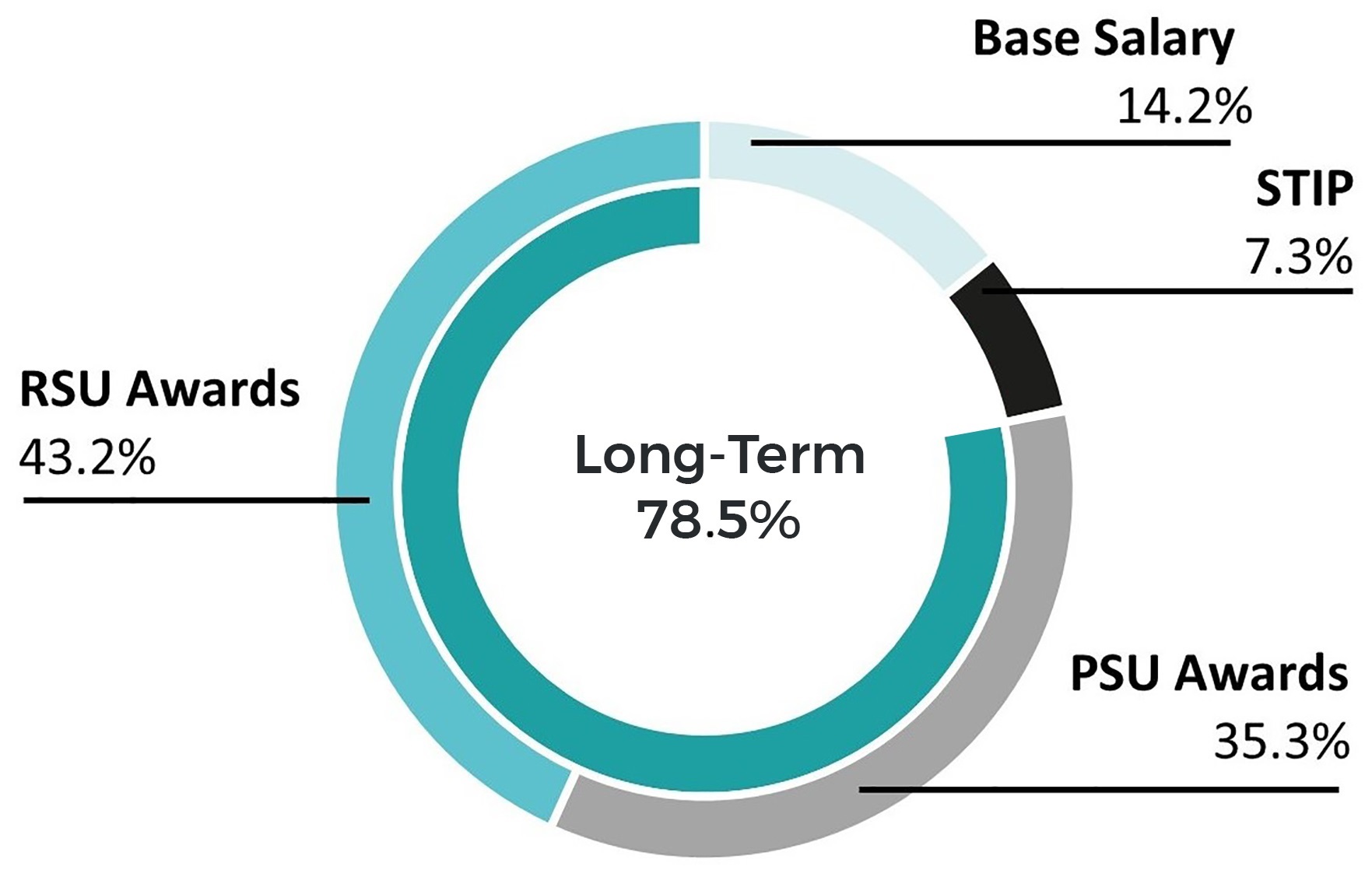

2023 Compensation Program SummaryGiven the positive Say-on-Pay result at our 2022 Annual Meeting and feedback from our subsequent stockholder engagement meetings, the Compensation Committee approved our 2023 compensation program with features similar to our 2022 compensation program design, with the addition of two new performance metrics to our short-term incentive plan – revenue and NEBITDA – to further align compensation with our business strategy. During our fall 2022 engagement, our stockholder engagement team discussed the potential addition of these two new metrics with stockholders, who were supportive of the change. Approximately 92% of our CEO’s total target pay (and approximately 87% of all other NEOs (average)) is considered variable, with approximately 80% of all NEOs’ target pay considered long-term. The target mix of compensation provided to our chief executive officer and average of our other NEOs for 2023 is set forth below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| About GoDaddy | | | Proxy Summary | | | Board and Governance Matters | | | Executive Compensation | | | Audit Matters | | | Other Management Proposals | | | Other Information |

The chart below provides a summary of the elements that made up the compensation program for our NEOs for 2023, including the rationale for each element. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ELEMENT |

| | | | | | | | | |

| FIXED | VARIABLE |

| | | | | | | | | |

| | | | | | | | | |

| BASE SALARY | | 2023 SHORT-TERM INCENTIVE PLAN1 | | 2023 LONG-TERM INCENTIVE PLAN1 |

| | | | | | | | | |

| | | | | | | | | |

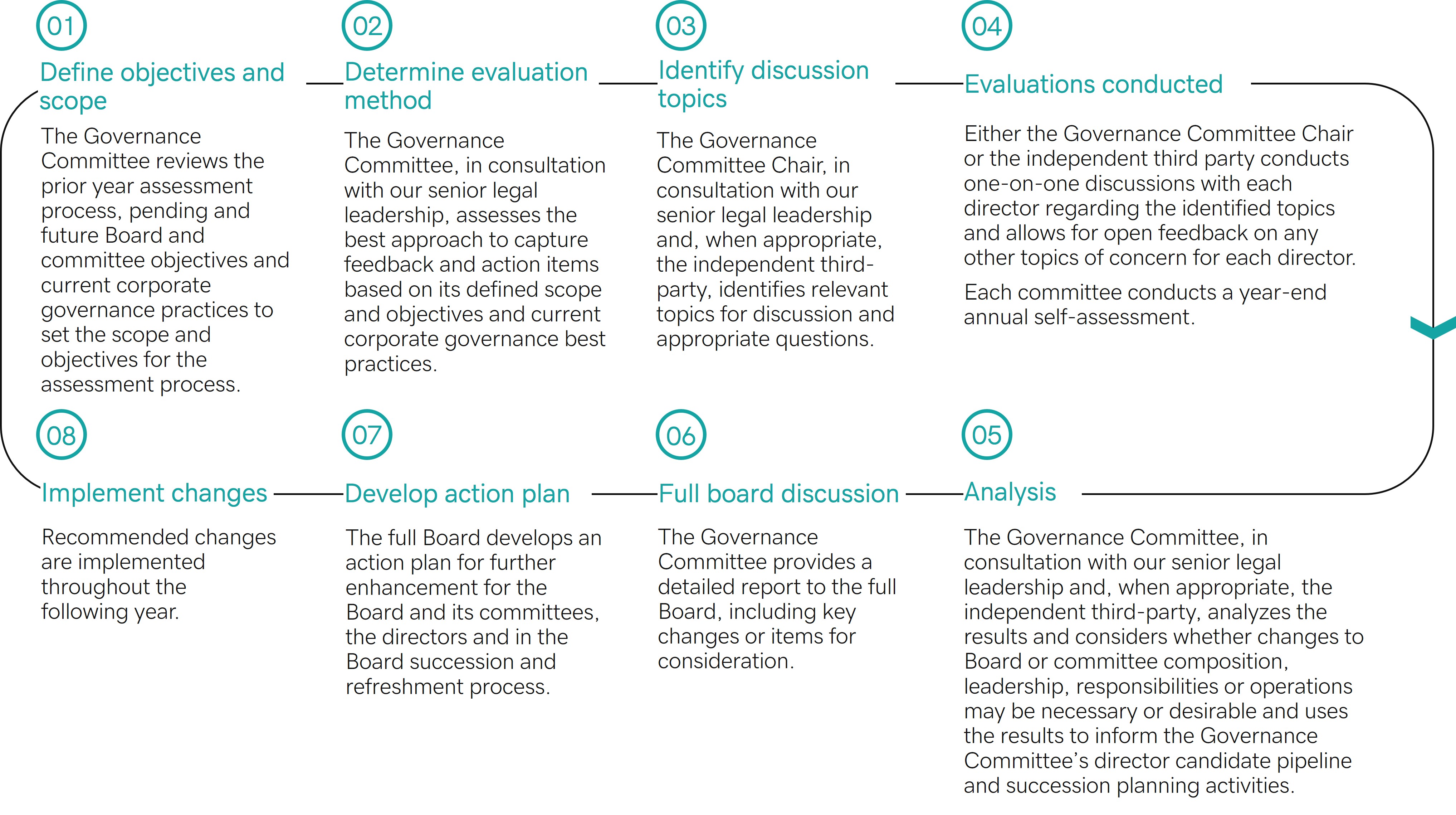

| | | | | | | | | |